Scottsdale-based real estate investment firm Caliber recently invested $6.8 million into apartment renovations near Grand Canyon University. The investment exemplifies the significant advantages that the Tax Cuts and Job Act’s opportunity zones provide.

In just eight years, GCU has grown its campus student body by over 1800 percent, expanding from just under a thousand students in 2009 to 19,000 in 2017. In fact, their online student body has jumped over 172 percent in the same timeframe as well. Caliber noticed the rapid growth in 2015 and bought the property for roughly $6.5 million – because of the Tax Cuts and Jobs Act, they can now invest more into the community with better tax incentives.

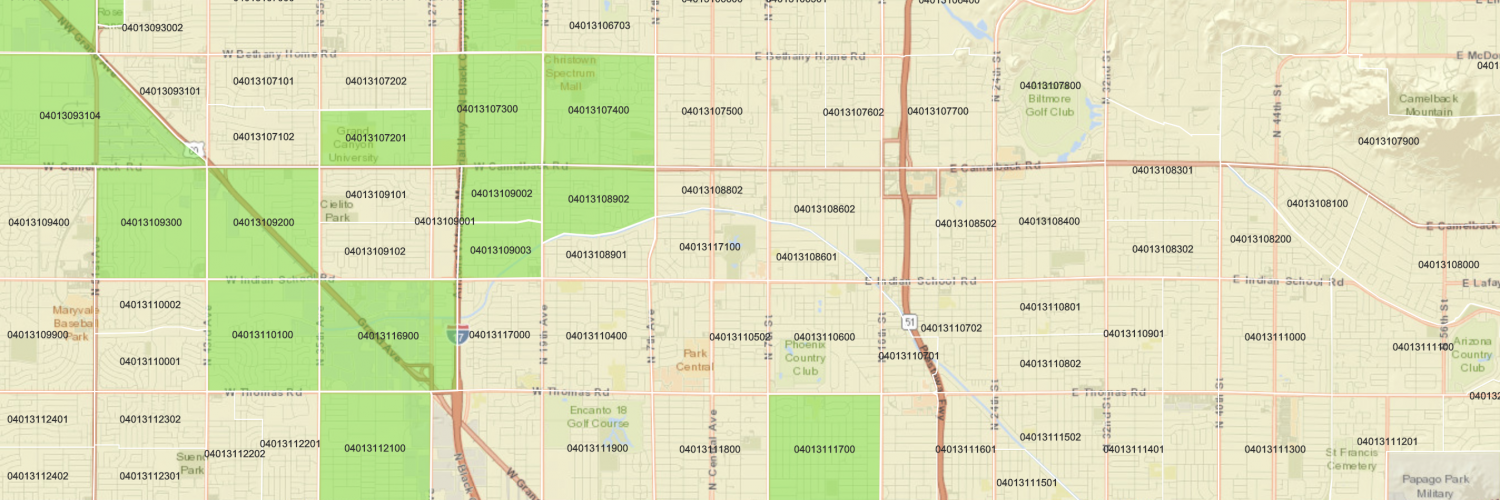

Further, the Tax Cuts and Jobs Act created 168 opportunity zones across the state – under the law, investors can reinvest capital gains into one of these zones within 180 days to postpone tax payments on those capital gains. Additionally, all capital gains from the sale of opportunity zone investments are exempt from taxes after ten years. Consequently, this proves to be a major boon for both real estate investors and these areas that otherwise would be less likely to attract investors.

Caliber president and co-founder Jennifer Schrader expresses her excitement for this opportunity. “When opportunity zones were first announced, we saw it as a great way to invest. The old way, we were limited to the 1031 (exchanges) or, in many cases, business owners not ready to sell because the tax consequences were too high,” says Schrader. “Now with Caliber’s Opportunity Zone Fund, it will provide Caliber another avenue to invest directly in the communities where it’s most needed.”

Caliber plans on capitalizing on this opportunity in other areas as well. Scott Celley, Caliber’s government relations liaison, explains that Downtown Mesa is Caliber’s next target, citing its rapid development as the main investment driver. “The light rail is completed in Downtown Mesa and they’ve had some other improvements. ASU has also talked about placing a new campus in Downtown Mesa — as a result, Caliber has acquired about 10 properties in Downtown Mesa,” he said. “A number of other Arizona developers have acquired properties in the area as well. They would show you about 20+ locations are being evaluated for redevelopment.”

The law is generating new development for lower income and rural communities. As investors pump more money into opportunity zones, they will create safer places to work and live, consequently attracting more residents and generating more job opportunities. Real estate like the apartments near Grand Canyon University will improve due to investment firms like Caliber capitalizing on these tax exemptions.

Related: A new tax incentive program could bring private investors to struggling rural areas

Add comment