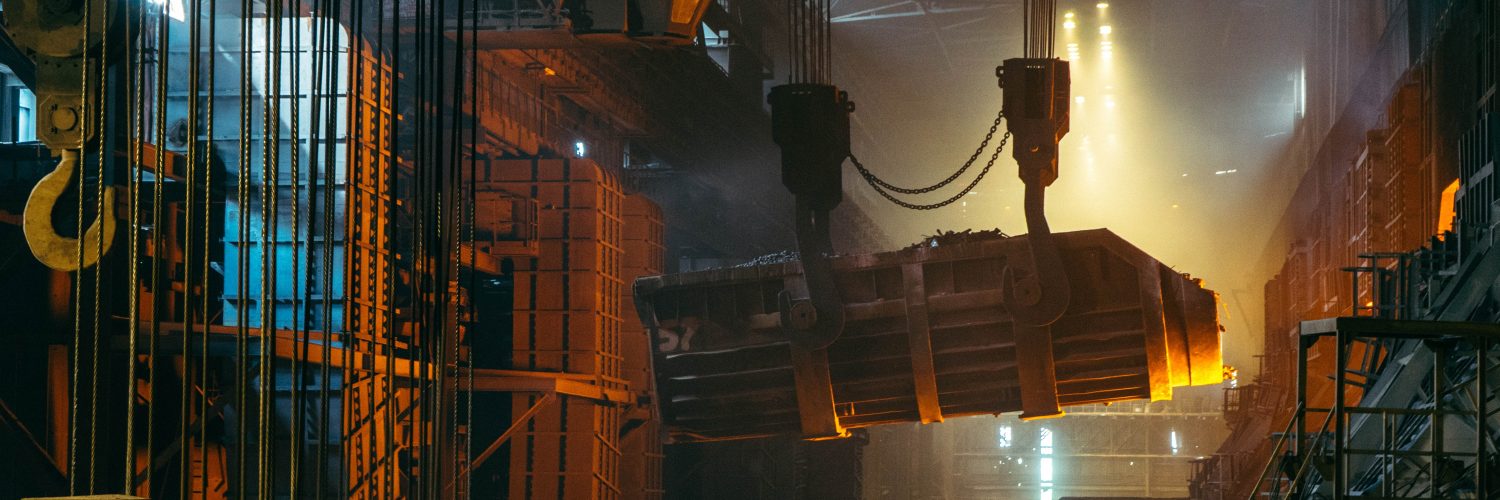

The White House’s announcement on May 31 that the U.S. is slapping tariffs of 25 percent on steel and 10 percent on aluminum exports from allies Canada, Mexico and the European Union blindsided even international trade experts.

“The actions against China should come as no surprise,” said Lee McPheters, a research professor of economics at the Seidman Research Institute at the W. P. Carey School of Business at Arizona State University. “The extension of tariffs to allies such as Canada (the No. 1 supplier of steel) is hard to justify and particularly strange since the claim is made the tariffs are for national security.”

For now, the effects on Arizona’s economy may be small compared to other states, McPheters said.

“Many important Arizona industries rely on steel, including aerospace, other manufacturing and heavy construction,” he said. “However, we should not lose sight of the fact that our strongest growth sectors in recent years have been finance, health care and business services. Higher steel prices will be felt by consumers, and it is likely the overall rate of inflation will increase, but the tariffs as currently structured do not seem capable of having a major impact on Arizona’s growth. But, and this is critical, if the tariffs lead to slower national growth, Arizona will follow the national business cycle and overall growth may be affected.”

Some Arizona businesses are already feeling the sting.

Carlos Ruiz, owner and operator of Tucson-based HT Metals, thought a trade war would be averted after Congress passed its tax cut bill. Because his business custom cuts raw material for its customers, there was little he could do to plan ahead.

Ruiz said as soon as the tariffs were announced, prices for aluminum and steel “increased overnight on the products I buy. Likewise, overnight my purchasing power shrunk 25 percent.”

“The ‘national security’ claim for needing these tariffs is weak. The tariffs don’t distinguish between the mild carbon steel used to make wrought iron fencing/decorative features and the alloy steel used to make gears, bearings or ballistic plate,” Ruiz added. “The tariffs don’t distinguish between the aluminum used in aircraft/aerospace applications and the aluminum to make a computer cabinet.”

Ruiz has told his customers that they will have to accept price increases and is urging them to buy larger volumes of product.

No stranger to going toe-to-toe on trade with the U.S., Mexico struck back first, raising tariffs on steel, lamps, cheese, pork, apples, grapes and cranberries. The list may sound strange, but Mexico’s first salvo targets congressional districts heavy with supporters of President Donald Trump. The EU and Canada immediately used the same strategy.

Besides targeting key districts, the retaliation exposes the soft underbelly of the nation’s agricultural sector.

“Arizona agriculture is a $23.3 billion industry,” said Stefanie Smallhouse, president of the Arizona Farm Bureau. “In 2017, 61 percent of our agricultural exports were purchased by NAFTA trading partners. At this point, it looks like Arizona will need to worry about the potential tariffs coming from China in the way of tree nuts, wine, pork, cotton, beef and dates, but also a hit to pork and dairy from Mexico and some vegetables from Canada.”

McPheters of ASU said that a reduction in Arizona agricultural exports “would soon be followed by cutbacks and job losses among supplier industries.”

Ruiz has already written letters to Trump and Senators John McCain and Jeff Flake about the tariffs’ negative effects. The state’s agricultural sector, on the other hand, is organized and fighting.

“The Arizona Farm Bureau has been communicating with our congressional members continually as to the importance of uninterrupted trade with NAFTA countries and others around the globe,” Smallhouse said. “There is a very large coalition of agricultural groups working together as Farmers For Free Trade, spanning from a local to a national presence.”

Add comment