Latest news from Washington, D.C. produced by Total Spectrum/SGA exclusively for members of the Arizona Chamber of Commerce & Industry

More Info: Michael DiMaria | Partner and Vice President of Business Development | 602-717-3891 | [email protected]

Thanks for your interest in Washington, D.C., and thanks for reading This Week in Washington.

Our goal is to provide you with all the information you need in a timely manner on the issues that are important to you. Our goal is also to publish on a regular schedule. Most of the time we can achieve both goals… but this week we simply can’t catch lighting in a jar.

Amy Walter, who recently took over the Cook Political Report, said this week that “this is the most consequential week of President Biden’s young Presidency,” – and she was correct. Today is the first day of the new fiscal year, and as Congress had not completed their work on this fiscal year’s budget, they passed a continuing resolution this week to continue funding at current levels until December 3. Congress will have to raise the debt ceiling before mid-October. The House of Representatives tried to vote this week on the Bipartisan Infrastructure Framework, but moderate Democrats and progressives couldn’t agree on a way forward. There is also work going on in both the Senate and the House on the proposed ‘soft’ infrastructure bill currently priced at $3.5 trillion that Democrats want to pass using the budget reconciliation process.

I had dinner with a Senior Republican Senator this week, and he said that the smart money would probably bet that a ‘soft infrastructure bill’ of about $2 trillion would pass the Senate and a bipartisan traditional infrastructure bill will eventually pass the House. But he added that there is a 20% chance that the wheels will fall off the wagon and the President’s agenda goes into the ditch.

Taking all of this into account, you’ll understand why we adjusted our schedule this week to give Patrick Robertson enough time to accurately report on all the week’s events, including the very latest on the ‘Manchin-Sinema vs. Progressives’ tug-of-war.

Today’s This Week includes Patrick’s summary and analysis of the week’s crazy events in his Washington Whispers. Congressman Erik Paulsen writes about a Ways and Means proposal that is not good news for many small businesses, and Al Jackson updates on all things defense. Ramona Lessen summarizes two recent Senate hearings – one on CARES Act Oversight of the Treasury and Federal Reserve, and another reviewing the administration of laws under jurisdiction of the Federal Energy Regulatory Commission.

We’re already planning the October 13th issue, which will include the next Total Spectrum Spotlight.

Stay well.

Steve Gordon, Managing Partner

Washington Whispers

By Patrick Robertson, Total Spectrum Strategic Consultant

This week, Democrats in Washington took one step forward, two steps back, no real steps, or something in between, depending on who is analyzing the actions of the last few weeks. Let’s start with the facts, as we always do in Washington Whispers.

This week, Congress passed:

- A nine-week continuing resolution, funding the federal government through December 3.

However, the following items remain hanging out there and unresolved:

- The $1.2 trillion bipartisan infrastructure package;

- The $3.5 trillion Biden social infrastructure proposal that Senate Democrats want to pass under the budget reconciliation process;

- The lifting or extending of the debt ceiling, which is set to expire in mid-October; and

- Other policy priorities, like immigration reform.

We have arrived at the make-or-break moment for the Biden agenda in Congress. If negotiations take much longer there will be little or no chance to move something big before next November’s elections. After the events of Thursday, the president has achieved a COVID relief package but has not yet been able to strike a final deal on renewed infrastructure package that passed the Senate in August with a 69-30 vote. Progressives in the House have refused to move forward on the infrastructure bill until they know more about the fate of their priority – the multitrillion-dollar reconciliation package.

The President ran on broad social promises like immigration reform, government-supported childcare, higher taxes, election reform, better health care, and more support for higher education. None of those things will happen if the Senate does not come to an agreement on the reconciliation package.

The President and a Democratic-controlled Congress hit the ground running, passing the American Rescue Plan with COVID relief, COVID spending, and other short-term priorities like state and local government relief. Then they turned their attention to infrastructure and moderate Senators ran roughshod over the House, cutting a deal with the White House on what has become known as the Bipartisan Infrastructure Framework (BIF).

House progressives started to howl once the infrastructure bill passed the Senate and said that they would only support the infrastructure bill if the House agreed to move the President’s full agenda at the same time. Moderate Democrats then dug in their heels and got an understanding from the Speaker that the infrastructure bill would have a vote in the House on September 27, and without a vote moderate democrats refused to support the $3.5 trillion reconciliation package. This sounds a lot like two grade school children fighting over playground equipment to me.

The standoff was supposed to end this week when the House, almost two months after the Senate, was scheduled to vote on the BIF. Progressives stood up to say, “Not so fast,” as it became clear that Senate moderates scoffed at their $3.5 trillion reconciliation package. As a result, the infrastructure bill hangs in the balance. Senate Democratic moderates have said, “elect more progressives” if you want more progressive policies, and Washington is at a standstill.

The question now is how can the President shake his agenda loose of the Democratic gridlock that has been gripping it for months?

News broke this week that Senator Joe Manchin (D-WV), who gets more press coverage than really anyone in Congress these days, offered Senate Majority Leader Schumer a framework for a deal in July. Senator Manchin’s framework included a corporate tax rate increase, an increase in the capital gains rate, a cap on spending at $1.5 trillion and oversight over climate policy for the coal-state Senator. The following months of silence indicate it was not well received.

At the same time, Senator Kyrsten Sinema (D-AZ) has said that climate change policy is key to her vote and that she is not interested in major tax increases. Climate policy does not play well with Senator Manchin.

When you take these two positions of cutting back the $3.5 trillion package and juxtapose them against Senator Bernie Sanders’ (I-VT), who said that $3.5 trillion in spending is already a compromise, you are hard pressed to understand how an agreement can be reached.

It’s clear that the President and Democratic Congressional leaders are going to have to get very serious about compromising if they are to move the central pillars of their agenda.

Senate liberals have already had their hopes dashed on a reconciliation move to do immigration reform when the Senate Parliamentarian ruled it would not be fit under the Senate’s Byrd Rule. Democrats now need to see if they can find any common ground within their 50-member Senate caucus to move something forward that will garner support from the center and the left.

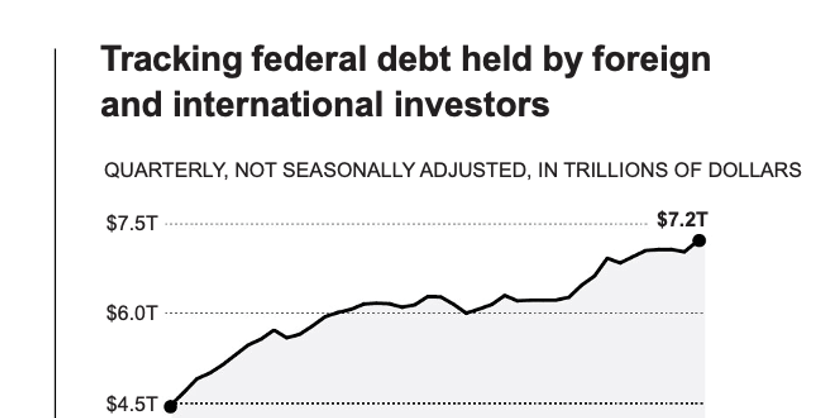

Democrats also need to find a way to lift or suspend the debt ceiling, the statutory limit for borrowing money by the federal government. While there are several kooky ideas out there on how to do it – all the way from minting a $4 trillion coin to deciding the debt ceiling is unconstitutional – it is still most likely Congress will simply extend or suspend the limit as it has done dozens of times in the last two decades. The idea that our country could default on our debt is just unacceptable. There is a whole separate column to be written on the need to lift or suspend the debt ceiling and the related politics, but we will save that for next month.

In the meantime, keep watching the debate over infrastructure and reconciliation and watch for that make-or-break moment – which Democrats face imminently – when they must decide whether doing nothing is preferable to doing something less than what they want. I predict that once this reckoning happens, they will move on both the infrastructure bill and a reconciliation bill in the neighborhood of $2 trillion.

The Democrats’ Proposed Cap on the Small Business Deduction Will Hurt Over 900,000 Small Businesses

By Congressman Erik Paulsen, Total Spectrum Strategic Consultant

Congressman Richard Neal (D-MA), Chairman of the House Ways and Means Committee, has proposed in the House Democrat budget reconciliation legislation to severely limit Section 199A, the Small Business Deduction. This deduction is the centerpiece of the pro-small business tax reforms adopted in the Tax Cuts and Jobs Act passed into law in 2017.

According to Small Business Administration (SBA) figures last updated in 2019, the United States has 30.7 million small businesses which employ 40.7% of the private workforce. Depending on the industry, the SBA defines a small business as one that has fewer than 1,500 employees and a maximum of $38.5 million in average annual receipts.

The vast majority of small businesses are organized as pass-through entities (partnerships, S corporations, LLCs, and sole proprietorships), not as C corporations. The owners of these firms pay individual income tax on income derived from their business.

Section 199A specifically covers these pass-through entities and allows small business owners the ability to claim up to a 20% deduction on their share of the business’s income.

Chairman Neal’s proposal would cap the deduction at $500,000. The Joint Committee on Taxation estimates that capping this deduction would raise just over $72 billion over ten years. It would also devastate many small businesses that found this deduction to be a lifeline during the pandemic, or who wanted to invest in new jobs and equipment.

Another consequence is that many small businesses would now be forced to decide whether to structure themselves based on tax considerations rather than business considerations. This is because the owners of pass-through small businesses are taxed at a maximum tax rate of 37% while a C corporation is taxed at a maximum tax rate of 21%, a significant 16% difference. The small business deduction was adopted to ensure that business owners would not be penalized based on their choice of business entity. In other words, whether to operate as a C corporation or a pass-through entity should be determined by business considerations and not tax rates.

As a result of Chairman Neal’s proposed repeal of Section 199A, over 900,000 small businesses that currently benefit from the 20% deduction could see their top tax rate skyrocket from 29.6% to 46.4%.

That’s because the proposed legislation increases the top individual marginal tax rate from 37% to 39.6%. It also lowers the top bracket from $523,601 per individual and $628,301 for couples filing jointly to $400,001 per individual and $450,001 for couples filing jointly. The bill adds a new 3% surtax that includes business income and imposes the 3.8% net investment income tax on active business income. These tax changes would create a top 46.4% federal effective tax rate on passthrough business income before considering state and local taxes.

The effective rate is 17.6% higher than anything being proposed for corporations. The rate does not even include the expansion of the Self Employment Tax with which small businesses would be burdened.

Many small business associations and chambers of commerce are actively opposing the proposed cap on the small business deduction and are contacting members of their Congressional delegation.

Defense Update

By Al Jackson, Total Spectrum Strategic Consultant

The House of Representatives earlier this month approved their version of the National Defense Authorization Act (NDAA) for Fiscal Year 2022. The bill authorizes $740 billion to be spent on defense, providing $24 billion more than what the administration requested. It remains to be seen if the House and Senate Defense Appropriations Subcommittees will follow suit, however, this legislation portends more spending on defense.

The budget policy bill, passed by a bipartisan 316 to 113 votes, includes a 2.7% pay raise for troops starting in January, sweeping changes to military sexual assault prosecutions, and language requiring women for the first time to register for the military draft. The bill also contains several provisions related to Afghanistan, as lawmakers specifically address the debacle that resulted from the recent military withdrawal.

The House version of the NDAA mirrors the amount authorized by the Senate Armed Services Committee version approved earlier this summer and marks a victory for Republican lawmakers who indicated the military budget proposed by the administration was insufficient to counter threats like a growing Chinese military and worldwide terrorism.

House liberal progressives and House Armed Services Committee Chairman Adam Smith (D-WA) had argued for lower spending levels after years of big defense plus-ups under President Donald Trump, however, the House overcame those objections by voting down an attempt to undo the $24 billion add. The vote on that amendment was 142 in favor of the cut and 268 for the additional $24 billion. An amendment to impose a broad 10% cut was also defeated, 332-86.

Key parts of the House NDAA are as follows:

- The bill would create a 12-member bipartisan commission to investigate what happened in Afghanistan and whether there were intelligence missteps that led to America’s rapid evacuation of the country. The legislation would also require annual reports on the administration’s handling of long-distance counter-terrorism efforts now that there are no forces on the ground.

- It would fund 13 new ships for the Navy, including three new Arleigh Burke-class destroyers, and includes money for 85 F-35 fighters.

- Funding for the Ground-Based Strategic Deterrent, the next-generation ICBM, was protected against an effort from progressives to defund the program and keep the Minuteman III ICBMs working until 2040.

- The House language includes a 2.7% pay raise for members of the military and sweeping changes to the sexual assault justice system. It also would require women to register for the draft for the first time, something expected to be backed fully in the Senate.

- It also includes language that would require any Defense Secretary nominee who previously served in uniform to have been retired for a full 10 years, rather than the current requirement of seven years. This comes after back-to-back administrations sought waivers to clear Jim Mattis and Lloyd Austin to serve as the top civilian at the Pentagon, neither of whom had cleared the seven-year period at that time.

Procurement additions include:

- Aircraft: $394 million to buy four additional KC-130Js for the Navy and Marine Corps, $340 million for two additional P-8 Poseidon for the Navy, and $212 million for nine additional UH-60 Blackhawks for the Army National Guard.

- Combat vehicles: $234 million for Abrams tank upgrades, $183 million for HMMWV modifications, $139 million for Stryker upgrades, and $120 million for Joint Light Tactical Vehicles. The addition also covers $350 million more for missiles and $553 million to strengthen cybersecurity priorities.

Of note are the recent remarks from Frank Kendall, Secretary, United States Air Force, pertaining to the retirement of older, legacy systems such as the A-10 Warthog aircraft. These legacy aircraft are stationed at Davis-Monthan Air Force base in Tucson. Secretary Kendall implored Congress in his remarks to allow the USAF to retire these legacy platforms to free up funding for next-generation planes, drones, and weapons. “I have one request of the Congress: help us to focus on the one fight — the strategic competitive fight — we must win,” Kendall said during a speech at the Air Force Association’s Air, Space and Cyber conference.

In recent years, the service has shied away from seeking to retire full fleets of aircraft, as was common practice during the Obama administration when the Air Force unsuccessfully tried to divest its U-2 spy planes, RQ-4 Global Hawk surveillance drones, and A-10 Warthog attack planes. At the time, leaders from the Pentagon indicated the Budget Control Act caps made it impossible to modernize the force with next-generation aircraft while at the same time hanging on to aging planes that are expensive to maintain. Over the past two years, the Air Force has put forward budget proposals that called for retiring portions of certain aircraft inventories — several squadrons of A-10s, the oldest model Global Hawks, and dozens of aging KC-10 and KC-135 tankers. The retirement of these aircraft will impact the viability and economies associated with Davis-Monthan Air Force Base.

According to Secretary Kendall, these older fleets are “consuming precious resources we do need for modernization. While it’s understandable that lawmakers try to protect their districts’ economies, local political interests are coming at the expense of national security priorities.”

Kendall further adds, “it was a frequent occurrence during my confirmation process to have a senator agree with me about the significance of the Chinese threat, and in the same breath to tell me that under no circumstances could the — take your pick — C-130s, A-10s, KC-10s, [or] MQ-9s in that senator’s state be retired, nor could any base in his or her state ever be closed or lose manpower that would cause impact to the local economy.”

COVID-19 pandemic protections for defense contractors would be made permanent under the House’s version of NDAA. The safeguards, originally codified in Section 3610 of the CARES Act, allowed the Pentagon to reimburse contractors for paid leave if employees aren’t working due to the COVID-19 pandemic. Congress has had to act several times to renew the reimbursement authority, currently set to lapse after Sept. 30. The permanent protections are based on the Just in Case Act, authored by Representatives Rob Wittman (R-VA) and Anthony Brown (D-MD), which proposed expanded coverage for other emergencies, like hurricanes and floods. However, the bill passed out of committee with narrower, more pandemic-specific language.

Industry groups are pressing for the broader emergency powers to be included in the final NDAA for 2022 and for a short-term extension in the meantime. Both the National Defense Industrial Association and Professional Services Council said extending and expanding the 3610-reimbursement authority is their top legislative priority. Major defense contractors and their workers, such as Boeing, Raytheon, and Lockheed Martin will benefit from these provisions.

Congress will once again not complete their work as it relates to Fiscal Year 2022 appropriations, most likely relying on a continuing resolution (CR) to keep the government funded until December 3, 2021. As of time of print, the Republicans in the Senate are blocking the CR, as it also contains a controversial provision that would raise the debt limit. A resolution will be needed to avert a government shutdown on September 30 at midnight.

Hearing Report

By Ramona Lessen, Total Spectrum Executive Director

Senate Banking, Housing and Urban Affairs Committee Hearing on CARES Act Oversight of the Treasury and Federal Reserve: Supporting an Equitable Pandemic Recovery

Tuesday, September 28; 10:00 a.m.

To view a livestream of the hearing please click here.

Opening Statements:

Senator Sherrod Brown (D-OH)

Chairman

Senator Patrick J. Toomey (R-PA)

Ranking Member

Witnesses:

The Honorable Janet L. Yellen

Secretary

Department of the Treasury

The Honorable Jerome H. Powell

Chairman

Board of Governors of the Federal Reserve System

Senate Energy and Natural Resources Committee hearing

Full Committee Hearing to Review Administration Of Laws Within FERC’s Jurisdiction

September 28, 2021; 10:00 AM

To View a livestream of the hearing please click here.

Opening Statements:

Senator Joe Manchin (D-WV)

Chairman

Senator John Barrasso (R-WY)

Ranking Member

Witnesses:

The Honorable Richard Glick

Chairman

Federal Energy Regulatory Commission

The Honorable Mark C. Christie

Commissioner

Federal Energy Regulatory Commission

The Honorable Allison Clements

Commissioner

Federal Energy Regulatory Commission

The Honorable James Danly

Commissioner

Federal Energy Regulatory Commission

Japan, China lead foreign holders of U.S. federal debt

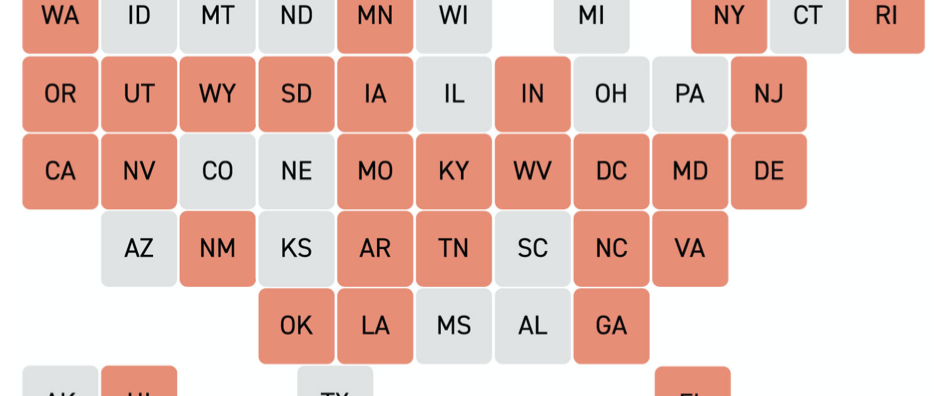

A majority of Americans 65 and older have been fully vaccinated

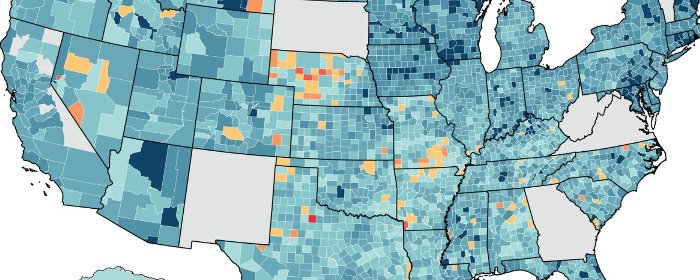

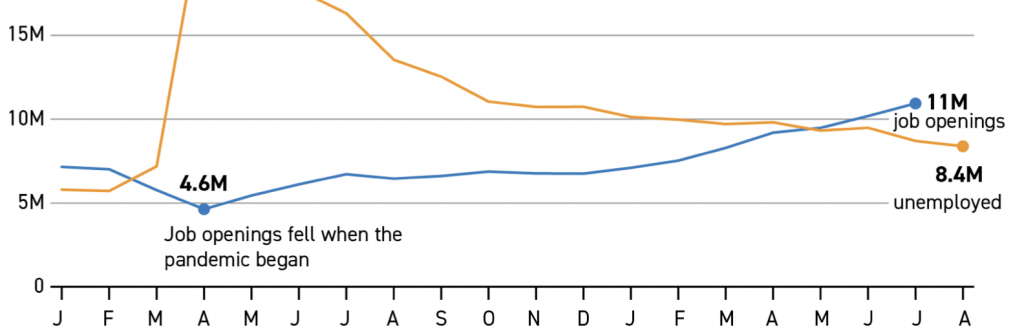

What you need to know about worker shortages

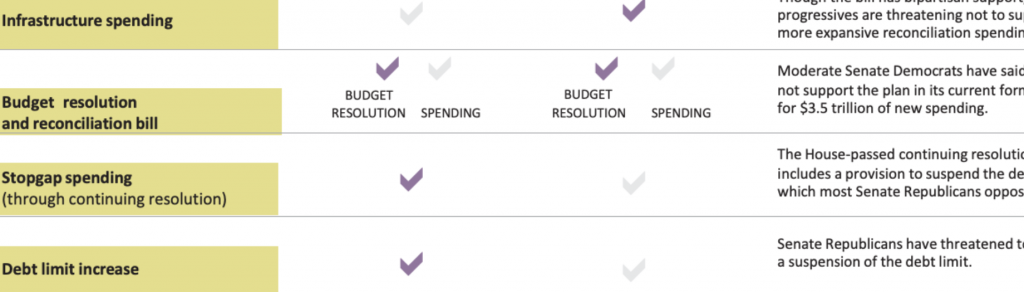

Why four budget issues are causing so many problems on Capitol Hill

What you need to know about free community college

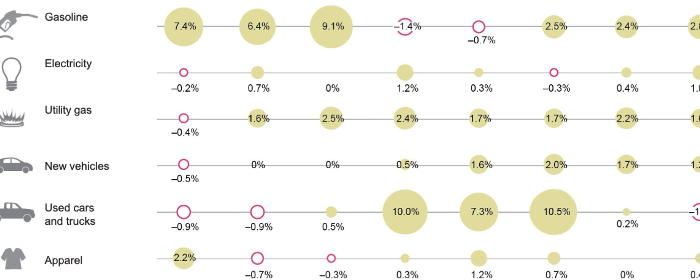

The Consumer Price Index went up in August — especially for gasoline

Congressional Calendar

All times EDT

Monday, September 27

- 2 p.m. House Rules Committee business meeting to consider the PUMP for Nursing Mothers Act, the Protect Older Job Applicants Act and the Family Violence Prevention and Services Improvement Act.

- 10 a.m. House Foreign Affairs Asia, the Pacific and Nonproliferation Subcommittee hearing on strengthening U.S. ties with Southeast Asia.

Tuesday, September 28

- 9:30 a.m. Senate Armed Services Committee hearing to examine the Afghanistan withdrawal. Defense Secretary Lloyd Austin, Chairman of the Joint Chiefs Mark Milley and U.S. Central Command Commander Kenneth McKenzie testify. Part of this hearing will be closed to the public.

- 10 a.m. House Financial Services Diversity and Inclusion Subcommittee hearing on increasing economic opportunity for “justice-involved individuals.”

- 10 a.m. House Judiciary Antitrust, Commercial and Administrative Law Subcommittee hearing on antitrust reforms.

- 10 a.m. House Economic Disparity and Fairness in Growth Select Committee hearingon the effects of globalization on U.S. economic disparities.

- 10 a.m. House Science Oversight Subcommittee virtual hearing on social media data.

- 10 a.m. House Transportation and Infrastructure Highways and Transit Subcommittee hearing on ferries.

- 10 a.m. Senate Banking Committee hearing to examine CARES Act oversight of the Treasury and Federal Reserve. Treasury Secretary Janet Yellen and Federal Reserve Chair Jerome Powell testify.

- 10 a.m. Senate Energy and Natural Resources Committee hearing on the jurisdiction of the Federal Energy Regulatory Commission. FERC Chair Richard Glick testifies, among others.

- 10:15 a.m. House Education and Labor Civil Rights and Human Services Subcommittee virtual hearing on models for preventing Covid-19.

- 2 p.m. House Foreign Affairs Africa, Global Health and Global Human Rights Subcommittee virtual hearing on conflict in Africa.

- 2 p.m. House Modernization of Congress Select Committee hearing on supporting agencies.

- 2:30 p.m. Senate Homeland Security Spending Oversight Subcommittee hearing to examine existing resources and innovations needed to replace legacy IT.

- 2:30 p.m. Senate Judiciary Constitution Subcommittee hearing on toxic conservatorships.

Wednesday, September 29

- 9:30 a.m. House Homeland Security Committee virtual hearing on the state of the Transportation Security Administration 20 years after 9/11. TSA Administrator David Pekoske testifies, among others.

- 10 a.m. House Judiciary Committee markup of pending legislation, including H.R. 2891 (117), the Preserve Access to Affordable Generics and Biosimilars Act.

- 10 a.m. House Financial Services Consumer Protection and Financial Institutions Subcommittee hearing on the future of banking.

- 10 a.m. House Agriculture Conservation and Forestry Subcommittee hearing on wildfire response and mitigation efforts.

- 10 a.m. House Small Business Underserved, Agricultural and Rural Business Development Subcommittee hearing on sustainable forestry as it related to climate change.

- 10 a.m. House Science Committee members day hearing.

- 10 a.m. House Oversight Civil Rights and Civil Liberties Subcommittee hearing on violent white supremacy.

- 10 a.m. Senate Commerce Committee hearing on protecting consumer privacy.

- 10 a.m. Senate Homeland Security Committee hearing on worsening natural disasters.

- 10 a.m. Senate Judiciary Committee hearing on Texas’ abortion law.

- 10:15 a.m. House Education and Labor Early Childhood, Elementary and Secondary Education Subcommittee virtual hearing on best practices for reopening schools.

- 10:30 a.m. House Energy and Commerce Oversight Subcommittee hearing on revitalizing the chemical safety board.

- 2 p.m. House Coronavirus Crisis Select Committee hearing on infrastructure updates in state and local public health departments.

- 2 p.m. Senate Foreign Relations Committee virtual hearing on pending nominations.

Thursday, September 30

- 9 a.m. Senate Judiciary Committee business meeting to consider the nomination of Rachael Rollins to be U.S. Attorney for Massachusetts.

- 1 p.m. House Foreign Affairs markup of pending legislation.

- 9:30 a.m. Senate Armed Services Committee hearing on Afghanistan.

- 10 a.m. House Financial Services Committee hearing on oversight of the Treasury Department and Federal Reserve’s pandemic response.

- 10 a.m. House Oversight Committee hearing on abortion rights and access.

- 10 a.m. House Transportation and Infrastructure Committee hearing on the federal government’s Covid-19 response.

- 10 a.m. House Small Business Committee hearing on providing capital to employee-owned businesses.

- 10 a.m. Senate Banking Committee hearing on pending nominations to positions at the U.S. Export-Import Bank.

- 10 a.m. Senate Health, Education and Labor Committee hearing on school reopenings. Health and Human Services Secretary Xavier Becerra and Education Secretary Miguel Cardona testify.

- 10 a.m. Senate Foreign Relations Committee hearing on pending nominations.

- 10:15 a.m. House Education and Labor Subcommittee on Higher Education and Workforce Investment hearing – Protecting Students and Taxpayers: Improving the Closed School Discharge Process.

- 10:30 a.m. Senate Commerce Subcommittee on Consumer Protection, Product Safety and Data Security hearing – Protecting Kids Online: Facebook, Instagram, and Mental Health Harms.

- 10:30 a.m. House Energy and Commerce hearing – A Level Playing Field: College Athletes’ Rights to Their Name, Image and Likeness.

- 2 p.m. House Homeland Security Subcommittee on Oversight, Management and Accountability hearing – 20 Years after 9/11: Transforming DHS to meet the Homeland Security Mission.

Add comment