Latest news from Washington, D.C. produced by Total Spectrum/SGA exclusively for members of the Arizona Chamber of Commerce & Industry

More Info: Michael DiMaria | Partner and Vice President of Business Development | 602-717-3891 | [email protected]

Thanks for your interest in Washington, and thanks for reading This Week in Washington.

Today’s Heard on the Hill leads with the Leader – Senator Mitch McConnell. I was a consultant to him in his first campaign, and we reconnected recently at a series of events. I summarized his comments on key issues, and I think you’ll find this look into the Leader both informative and interesting. I also summarized the most current information on Rule 42, which could drastically change the number of illegal border crossings, and also the pending legislation that would provide additional funding for COVID tests and medications.

Congressman Erik Paulsen helped write the 2017 Tax Cuts and Jobs Act as a member of the House Ways & Means Committee. He has written an excellent article about the reasons why Congress should make the 2017 tax cuts permanent.

Al Jackson brings us up to date on defense and defense appropriations happenings, while Ramona Lessen reports on the House Homeland Security Committee’s April 5 hearing on mobilizing our cyber defenses.

Members of the Senate and the House will be back in the states and districts for the next two weeks, but This Week in Washington will be back on April 20th.

Stay well and stay happy.

Total Spectrum Managing Director

Heard on the Hill

By Steve Gordon, Total Spectrum Managing Partner

THE Leader

I first met Mitch McConnell in the summer of 1984. He was the judge-executive of Jefferson County and was running for the U.S. Senate against Senator Walter “Dee” Huddleston, who was first elected to the Senate in 1973. Few national observers gave McConnell much of a chance in the 1984 election – but they were wrong. Mitch McConnell is strategic, calculating, focused, bright, knows his mind, and he knows what it takes to win.

Sometime in 2023, Senator Mitch McConnell will eclipse Senator Mike Mansfield (D-MT) to become the longest serving party leader in the history of the U.S. Senate. He wants to lead his party back into the Senate majority in 2023, and non-partisan political newsletters like the Cook Report and Inside Elections with Nathan L. Gonzales each conclude that a new Republican Senate Majority is the most likely outcome.

I’ve been with Senator McConnell at two small events over the past few weeks, and he also sat for a long interview last week. His message was consistent in all three gatherings. The answers shown below are not intended to be his exact words but do reflect my recollection of his thoughts.

- On the nomination of Federal Judge Ketanji Brown Jackson to be the next Justice of the U.S. Supreme Court:

MM: The nominee is well qualified and exactly the kind of nominee you would expect from a liberal president. Those of us who aren’t supporting her are troubled by two things. In my case, it was not asking too much of her to agree with the late Justice Ginsburg and others that packing the Supreme Court is a bad idea. Her refusal to answer that question is an issue. Her attitude with the Committee regarding sentencing guidelines is also an issue. However, she will be confirmed this week by the Senate.

- What are the major issues in this November’s election?

MM: Inflation and gas prices. Democrats need to stop their spending, but they don’t want to quit doing what they are doing. They have done all the wrong things. They own this. It will take the Federal Reserve to squeeze inflation out of our economy. On COVID, we are insistent that new appropriations be handled by offsetting new costs with the cost of unspent COVID spending from past appropriation bills. We want to pay for new appropriations with old appropriations that have not already been spent.

- What will the November elections be about?

MM: The fall election will be a mid-term report card on Democratic government and President Biden’s approval rating will drive it. It is going to be a very good environment for Republicans. I have seen a generic Republican vote in past years that was plus-3 or 4. This year the generic Republican vote is around plus-9 or 10. But can we mess it up? You bet – by nominating people that can’t win in November. You have to nominate electable candidates, and I think we will have fully electable candidates that can and will win in November.

- On the Russian-Ukrainian War:

MM: We want the Ukrainians to win. From the beginning, the President has been pulling his punches and acting late from a sort of fear that he would provoke the Russians. Let’s be clear. The Russians are the ones who provoked this war. To be fair, the Administration has been picking up the pace somewhat and they are getting weapons and ammunition out more rapidly. But our goal must be to help the Ukrainians win. My current favorite line is from Senator Sasse of Nebraska, who says that we should give the Ukrainians anything that shoots. That works for me.

Immigration: Rule 42

Rule 42 expulsions refer to the removal of people by the U.S. Government who have been in this country when a communicable disease was present. It was initiated during the Trump Administration, and it has been carried forward by the Biden Administration – until now.

Secretary of Homeland Security Mayorkas said last week that Rule 42 would be rescinded on May 23, 2022, but expulsions would continue until then.

Three states – Arizona, Missouri, and Louisiana – announced that they will be suing the Biden Administration. They said that ending this restriction would cause “unprecedented crisis on the United States’ Southern border.”

Senator Mark Kelly (D-AZ) called it a “wrong decision.” Senator Kyrsten Sinema (D-AZ) called it “lacking of understanding about the crisis on the border.”

President Biden responded to pro-immigration people and announced that the rule would be rescinded. But Majority Leader Schumer can count at least seven Senate Democrats who oppose the Administration’s action. This is a hot potato for the Administration and moderate Democrats in the Senate.

Additional COVID Bill

Senator Romney was point for Republicans on a COVID bill. The Administration wanted $10 billion for domestic use and $5 billion for international use. The negotiated terms would provide $10 billion for therapeutics, tests/testing, and other supplies, but would not provide any funding for international use. The negotiated bill was paid for by repurposing unused funds from previous COVID relief bills – just as Leader McConnell had predicted.

This compromise proposal is being delayed by discussions on Rule 42. Expect that the compromise COVID bill will be considered by the Senate after the Easter recess.

Make the 2017 Tax Cuts Permanent

By Erik Paulsen, Total Spectrum Strategic Consultant

Four years ago, Congress passed and the President signed into law the first major tax reform in a generation. The Tax Cuts and Jobs Act (TCJA) cut taxes and lowered rates for families, small businesses, and large employers, and as a result, our economy grew. Unemployment reached historic lows, business optimism soared, investment in American manufacturing and research and development strengthened, and many employees saw their wages rise so they had more money in their pockets.

The TCJA kept the same number of individual tax brackets at seven but reduced each bracket by an average of around 3%. On the corporate side, it sharply reduced the tax rate from 35% to 21% so that the United States could compete with our trading partners and other economies around the world.

Additionally, tax revenues collected by the federal government came in at their highest levels ever. In fact, tax receipts for Fiscal Year 2021 saw their biggest one-year increase since 1977. Receipts topped $4.04 trillion, up by $627 billion from the $3.32 trillion that the government received in FY2020, according to the Congressional Budget Office. The CBO said the change reflected “the general strength of the economy over the past year.”

Corporate taxes saw the biggest jump, increasing by 75% over the same period in FY 2020. Individual income taxes and payroll taxes rose by a collective 15%. Individual income taxes alone saw a 27.5%increase, while payroll taxes saw a slight decline. The CBO found that higher income workers were paying a much higher share of the total revenues collected than in previous years.

The Gross National Product for FY2020 contracted by 3.5% due to the severe lockdown imposed in the spring by the federal government to combat the spread of the coronavirus. Once the lockdown was lifted, the economy began to recover rapidly. The fourth quarter of 2020 actually saw a 4% increase in the U.S. economy. Federal government spending played a significant role in keeping the economy afloat, particularly for businesses who were without workers and for workers who were prevented from working. However, the corporate and individual tax rate cuts enacted in 2017 clearly played a major role in stimulating the economy at the height of the pandemic.

While the Gross Domestic Product in FY2021 grew by almost 7%, it was not the banner year for America’s economy that many experts expected.

The slower economic growth can be attributed to:

- the Administration’s push to raise taxes on individuals, small businesses, and large employers;

- the highest inflationary price increases in 40 years after trillions of dollars in government stimulus spending;

- a resurgence of the Delta and Omicron variants with new government mandates; and

- what many argue was a slow response by the Federal Reserve addressing monetary policy.

Today, our nation and economy face a more uncertain future. Small business optimism continues to fall. American households are paying $5,200 extra this year to purchase the same basket of goods as last year due to inflation, and some economists are predicting a looming recession.

One of the best things Congress could do today to regain confidence across the entire spectrum of our economy would be to make the TCJA tax cuts permanent right now, rather than wait until 2024 or 2025.

While Federal Reserve Chairman Jay Powell “hopes” to get the rate of inflation down to 2% by the end of 2025, the cost of doing business or taking care of one’s family will continue to increase. Ensuring families and small businesses have more disposable income and additional money in their pockets to meet these challenges is an important step to take.

Defense Update

By Al Jackson, Total Spectrum Strategic Consultant

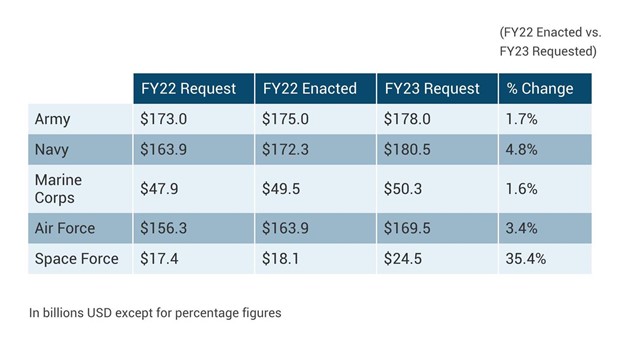

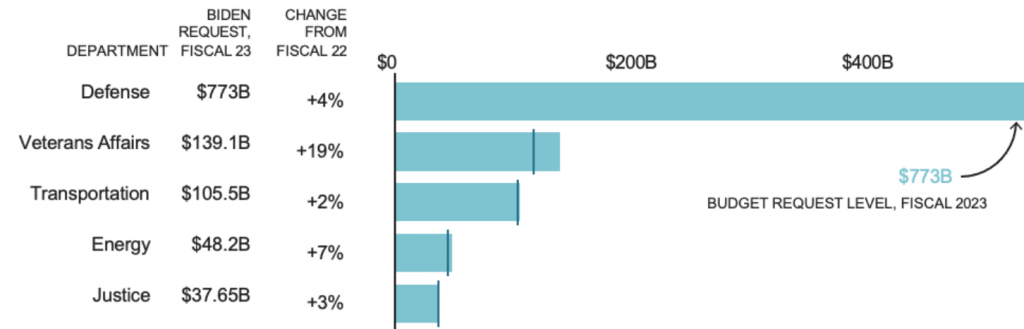

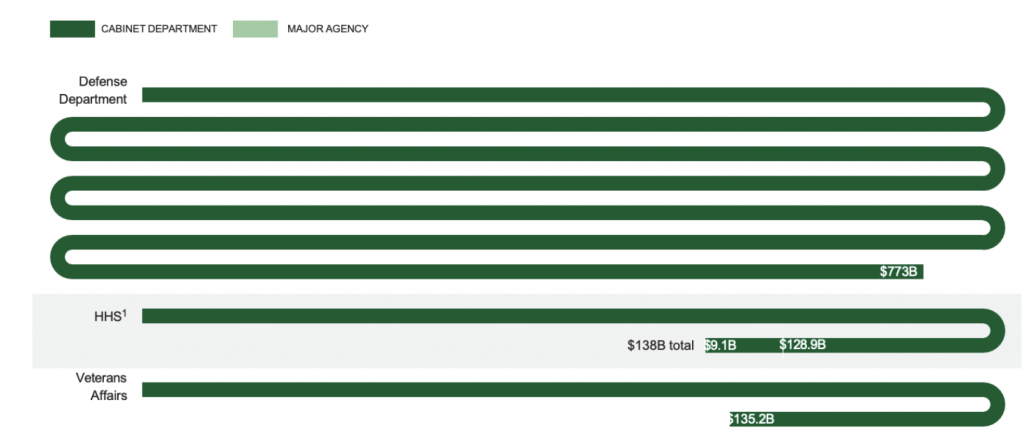

On March 28, 2022, the administration submitted to Congress its $5.8 trillion Fiscal Year 2023 budget. The proposed budget for the Department of Defense is $773 billion, which Republicans have already attacked as insufficient. The total spending plan translates to an increase of more than $30 billion, or 4%, over the FY2022 enacted level. Last year, White House officials sought a boost of less than 3%. Eventually, Republicans along with moderate Democrats added more to the Pentagon’s spending totals.

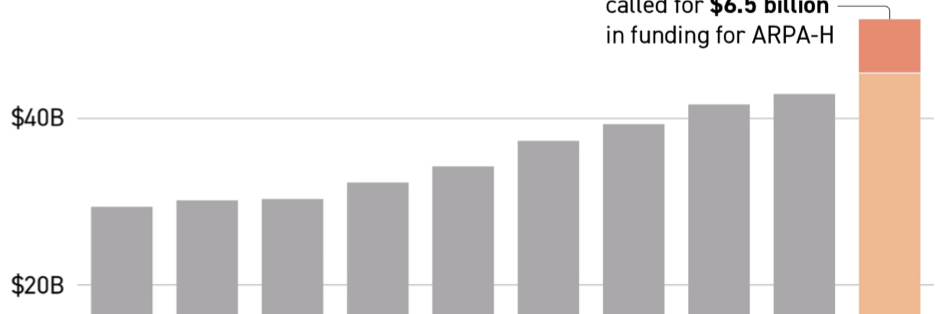

Emphasizing the threat of both China and Russia, the administration proposes the Pentagon’s largest research and development budget yet, at $130 billion for new weapons like hypersonic missiles. It would retire systems like the Littoral Combat Ship, citing the expense to maintain it, and the A-10 Warthog aircraft, which defense officials argue isn’t relevant to modern conflict. (The A-10 is relevant to Air Force bases in Arizona.) The proposal also funds $4.2 billion for the European Deterrence Initiative, an increase of $360 million, with new funds to aid Ukraine in its efforts to thwart invasion from Russia. According to the administration, these new funds will adequately counter “persistent threats including those posed by North Korea, Iran, and violent extremist organizations.” The Pentagon, with China still its “pacing challenge,” seeks $6.1 billion for the Indo-Pacific Deterrence Initiative.

In estimating future spending, the Pentagon, the White House, and the Congressional Budget Office have for years assumed a 2% inflation rate for budget growth. This year, the CBO updated its 2021 inflation forecast to 5.4%. A recent McKinsey & Company report estimated the Defense Department “could have $692 billion in buying power in 2026 [at FY23 spending levels].” Moreover, should 7% inflation continue, the purchasing power of $732 billion shrinks to $578 billion.

Ranking Members of both Armed Services Committees, Representative Mike Rogers (R-MS) and Senator Jim Inhofe (R-OK), expressed concerns about the proposed funding level in a letter to the administration. The letter asks Defense Secretary Lloyd Austin and the Armed Services secretaries to explain how they determined their inflation rate, noting the Labor Department’s calculation of the Consumer Price Index at 7.9%, a 40-year high. Both are among several Republicans who have called for a 5% increase of funding above inflation. “[P]ut simply, the inflation we are experiencing is effectively a 5 to 8 percent cut to the department’s buying power, which could amount to between $20-$30 billion in unfunded costs in fiscal year 2022 alone, not to mention lost buying power in fiscal 2021 and potential lost buying power in fiscal year 2023,” Rogers and Inhofe noted in their letter.

Below is a breakdown by Armed Service of the FY2023 request vs. FY2022 appropriations.

The budget again this year emphasizes research, development, test, and evaluation funding, requesting $130.1 billion; this 9.5% increase is the “largest ever.” Included in this request are $4.7 billion for hypersonic weapons, $3.3 billion for microelectronics and 5G networking, and $1.3 billion for biotechnology.

Despite being rebuffed by Congress last year, the Pentagon continued attempts in FY 2023 to divest from older legacy systems by reprioritizing $2.7 billion in spending. The Air Force would retire 150 aircraft and transfer 100 MQ-9s to another government agency, while the Navy would decommission 24 ships, 16 before the end of their service lives. Some of those 100 MQ-9 aircraft will be transferred to Customs & Border Patrol, Office of Air & Marine Operations. From the administration’s budget statement: “[T]he department had some success last year making progress in some of these areas, and the reason the department keeps asking is it’s something that needs to happen.”

It also includes full funding for modernizing all three aspects of the nuclear triad, with $34.4 billion for the nuclear enterprise. That includes $6.3 billion for the Columbia-class submarine, $5 billion for the B-21 bomber, $3.6 billion for the next-generation intercontinental ballistic missile known as the Ground Based Strategic Deterrent, and $4.8 billion for nuclear command-and-control systems.

The Air Force’s budget for FY2023 calls for divesting 150 aircraft, including older A-10 Warthogs, F-22A Raptors, T-1 Jayhawks, and KC-135 Stratotankers. The Department of the Air Force’s budget (encompassing both the Air Force and Space Force) would grow to $194 billion, nearly a 7% increase from the approximately $182 billion approved for FY2022. The Air Force’s portion of that budget would be about $169.5 billion. The requested Research and Development funding would increase by $9 billion, including funding for the Ground Based Strategic Deterrent, NGAD, and the B-21 family of systems.

Air Force Secretary Frank Kendall indicated the Air Force had to make “hard choices” about cutting down its aircraft fleet, although the proposed retirements are not as dramatic as the 200+ retirements proposed in the FY2022 budget proposal. “We have to get rid of, what I’ll call legacy equipment in order to have the resources to modernize,” Kendall said.

The Air Force will once again try to retire some A-10 Thunderbolt II attack planes. The proposed FY2023 budget targets cuts of 21 Air National Guard A-10s at Fort Wayne, Indiana, and plans to transition that squadron to the same number of F-16s. The service sought to cut 42 A-10s in 2022, but Congress ultimately blocked those retirements in the National Defense Authorization Act, while allowing all other retirements the Air Force sought.

While some have called for transferring A-10s, originally designed to destroy columns of Russian tanks invading Europe during the Cold War, to Ukraine, Secretary Kendall indicated that war has indirectly shown how the Warthog is outdated and due for retirement. As reported in the Defense News, “Ukraine’s ground-based tactical air defenses have proven to be devastatingly effective against Russia, Kendall said, keeping them from achieving air superiority and conducting aerial operations. The A-10, while rugged, is slow and vulnerable to those types of defenses. While the A-10, from a point of view of delivering munitions, would be terrific for killing Russian tanks, etc., its survivability would be in question,” Kendall said. “That’s one of the reasons that we need to move beyond the A-10, because we’re worried about high-end threats now. We’re not worried about the same threats we were worried about, at least to the same degree, when we were doing counterinsurgencies or counterterrorism.”

Resistance of that logic from Representatives and Senators from states where the A-10 resides remains to be seen. Posture hearings from Armed Services Committees in both the House and Senate begin in earnest this week, as FY2022 ends on September 30, 2022.

The steepest cuts to individual fleets, as a percentage, will come to the aging E-8 Joint Surveillance Target Attack Radar System, or JSTARS, and E-3 Sentry. The Air Force would retire eight of its JSTARS in 2023, and the final four FY2024, completing the fleet’s divestment. The first four JSTARS retirements are planned for FY 2022.

Hearing Report

By Ramona Lessen, Executive Director, Total Spectrum

House Homeland Security Committee hearing on Mobilizing our Cyber Defenses: Securing Critical Infrastructure Against Russian Cyber Threats

Tuesday, April 5, 2022; 10:00 a.m.

To view a livestream of the hearing please click here.

Representative Ritchie Torres (D-15th-NY), Majority Vice Chair

Representative John Katko (R-24th-NY), Ranking Member

Witnesses:

Mr. Adam Meyers

Senior Vice President for Intelligence

Crowdstrike

Mr. Steve Silberstein

Chief Executive Officer

Financial Services Information Sharing and Analysis Center

Mr. Kevin M. Morley, PhD

Manager, Federal Relations

American Water Works Association

Mr. Amit Yoran

Chairman and Chief Executive Officer

Tenable, Inc.

Congressional Calendar

Monday, April 4

- 10 a.m. Senate Judiciary Committee business meeting to consider Jackson’s nomination, as well as six other nominees.

- 3 p.m. House Rules Committee business meeting on a resolution recommending that former Trump administration officials Peter Navarro and Dan Scavino be held in contempt of Congress for refusing subpoenas issued by the Jan. 6 Committee to investigate the attack on the Capitol.

Tuesday, April 5

- 9:30 a.m. House Armed Services Committee hybrid hearing on the fiscal 2023 budget request for defense.

- 9:30 a.m. Senate Armed Services Committee hearing on the fiscal 2023 budget request for the U.S. Special Operations Command and Cyber Command.

- 10 a.m. House Agriculture Committee hybrid hearing on renewable energy opportunities in the farm bill.

- 10 a.m. House Appropriations Interior-Environment Subcommittee hearing on the fiscal 2023 budget request for tribal organizations.

- 10 a.m. House Appropriations Legislative Branch Subcommittee hearing on the 2023 budget request for the Government Accountability Office.

- 10 a.m. House Homeland Security Committee hearing on securing critical infrastructure against Russian cyber threats.

- 10 a.m. House Foreign Affairs Committee hybrid markup of five measures, including one that would require the U.S. to develop a strategy to counter Russian influence.

- 10 a.m. House Science Committee hybrid markup of five bills, including one that would strengthen the chief scientist of the National Oceanic and Atmospheric Administration’s role.

- 10 a.m. House Judiciary Constitution, Civil Rights and Civil Liberties Subcommittee hearing on enhancing the Foreign Agents Registration Act of 1938.

- 10 a.m. House Natural Resources National Parks, Forests and Public Lands Subcommittee hybrid hearing on investing in wildfire management, ecosystem restoration and resilient communities.

- 10 a.m. House Natural Resources Oversight Subcommittee virtual hearing on the opioid crisis in tribal communities.

- 10 a.m. House Oversight Committee hearing on developing electric postal service vehicles.

- 10 a.m. House Transportation Economic Development and Emergency Management Subcommittee hybrid hearing on FEMA’s priorities for the 2022-2026 strategic plan.

- 10 a.m. Senate Banking Committee hearing on insider trading legislation.

- 10 a.m. Senate Commerce Committee hearing on transparency in petroleum markets.

- 10 a.m. Senate Environment Fisheries, Water and Wildlife Subcommittee hearing on the implementation of S. 914, the Drinking Water and Wastewater Infrastructure Act of 2021.

- 10 a.m. Senate Finance Committee hearing on the fiscal 2023 budget for the Health and Human Services Department.

- 10 a.m. Senate HELP Committee hearing on Food and Drug Administration user fee agreements. 430 Dirksen.

- 10:15 a.m. House Education and Labor Committee hybrid markup of two measures, including H.R. 7309, which would overhaul the workforce development system.

- 10:15 a.m. House Energy and Commerce Health Subcommittee hybrid hearing on legislation to support communities’ mental health.

- 11 a.m. Senate Budget Committee hearing on corporate fuel profiteering on price inflation.

- 1 p.m. House Appropriations Legislative Branch Subcommittee hearing on the 2023 budget request for the Congressional Budget Office.

- 1:30 p.m. House Rules Committee business meeting to consider a bill that would increase appropriations for the Restaurant Revitalization Fund.

- 2 p.m. House Financial Services Subcommittee on Oversight and Investigations hearing – The Role of Financial Institutions in the Horrors of Slavery and the Need for Atonement.

- 2 p.m. House Judiciary Committee markup of eight bills, including one that would seek to prevent domestic terrorism and another that would eliminate the per-country numerical limitation for employment-based immigrants.

- 2 p.m. House Ways and Means Committee hybrid hearing on the fiscal 2023 budget. HHS Secretary Xavier Becerra testifies.

- 2:30 p.m. Senate Armed Services Committee CLOSED hearing to receive testimony on training the next generation of cyber operators

- 3 p.m. House Armed Services Subcommittee on Cyber, Innovative Technologies, and Information Systems Hearing: “Operations in Cyberspace and Building Cyber Capabilities Across the Department of Defense”.

- 3 p.m. House Appropriations Legislative Branch Subcommittee hearing on the 2023 budget request for the Office of Congressional Workplace Rights.

Wednesday, April 6

- 9 a.m. House Congress Modernization Committee hearing on the legislative branch’s preparedness for a crisis.

- 9 a.m. House Education and Labor Committee hybrid hearing examining HHS policies.

- 9:30 a.m. House Appropriations Defense Subcommittee closed hearing on United States Africa Command

- 10 a.m. House Agriculture Committee hybrid hearing on international trade and food assistance programs in the 2022 farm bill.

- 10 a.m. House Appropriations Homeland Security Subcommittee hearing on the 2023 budget request for Citizenship and Immigration Services.

- 10 a.m. House Appropriations Labor-HHS-Education Subcommittee hearing on social and emotional learning and whole child approaches in K-12 education.

- 10 a.m. House Appropriations State-Foreign Operations Subcommittee hearing on international assistance to combat narcotics trafficking.

- 10 a.m. House Financial Services Committee hybrid hearing to receive annual testimony from Treasury Secretary Janet Yellen on the International Financial System.

- 10 a.m. House Foreign Affairs Committee hybrid hearing on restoring American leadership in the Indo-Pacific.

- 10 a.m. House Homeland Security Cybersecurity and Infrastructure Protection Subcommittee hearing on public-private partnerships to secure critical infrastructure.

- 10 a.m. House Science Research and Technology Subcommittee hybrid hearing on evaluating support for small businesses.

- 10 a.m. House Small Business Rural Development, Agriculture and Trade Subcommittee hybrid hearing on the Small Business Administration advocacy Office.

- 10 a.m. House Transportation Committee hybrid hearing on reauthorizing the National Transportation Safety Board.

- 10 a.m. House Ways and Means Committee hybrid hearing on racism and economic opportunity.

- 10 a.m. Senate Appropriations Energy-Water Subcommittee hearing on the fiscal 2023 budget request for the U.S. Army Corps of Engineers and the Bureau of Reclamation.

- 10 a.m. Senate Armed Services Personnel Subcommittee hearing on suicide prevention and behavioral health interventions in the Department of Defense.

- 10 a.m. Senate Banking Committee hearing on two Treasury Department nominations.

- 10 a.m. Senate Environment and Public Works Committee hearing on the fiscal 2023 budget request for the Environmental Protection Agency.

- 10:30 a.m. House Appropriations Military Construction-VA Subcommittee hearing on the fiscal 2023 budget request for the Veteran Affairs Department.

- 10:30 a.m. House Energy and Commerce Oversight Subcommittee hybrid hearing on gas price gouging and inflation.

- 10:30 a.m. House Oversight Committee markup of eight measures, including one that would target deceptive practices in relation to the census, as well as several postal naming bills.

- 11:15 a.m. Senate Homeland Security business meeting to consider Derek Kan and Daniel Tangherlini to be governors of the U.S. Postal Service.

- House Economic Disparity Committee hearing on the impact of corporate power on workers and consumers.

- 1 p.m. House Appropriations Interior-Environment Subcommittee hearing on the fiscal 2023 budget request for regional tribal organizations.

- 1:30 p.m. House Appropriations Homeland Security Subcommittee hearing on the fiscal 2023 budget for the DHS inspector general.

- 2 p.m. House Appropriations Legislative Branch Subcommittee hearing on the fiscal 2023 budget for the House of Representatives.

- 2 p.m. House Armed Services Strategic Forces Subcommittee hybrid hearing on the fiscal 2023 budget for national security space programs.

- 2 p.m. House Homeland Security Border Security and Operations Subcommittee hearing on Title 42 and restoring asylum at the border.

- 2:30 p.m. House Budget Committee hybrid hearing on the fiscal 2023 budget request for HHS.

- 2:30 p.m. Senate Armed Services Emerging Threats and Capabilities Subcommittee hearing on the DoD’s posture for supporting innovation.

- 2:30 p.m. Senate Banking Transportation-HUD Subcommittee hearing on advancing public transportation in urban and rural areas.

- 2:30 p.m. Senate Environment Clean Air Subcommittee hearing on nominations to the Tennessee Valley Authority.

- 2:30 p.m. Senate Foreign Relations Committee hybrid hearing on three treaties.3:15 p.m. Senate Rules Committee hearing on Dara Lindenbaum’s nomination to be a member of the Federal Election Commission.

Thursday, April 7

- 9 a.m. House Administration Committee hybrid hearing on stock trade reforms for Congress.

- 9 a.m. House Climate Crisis Committee hearing on investing in energy efficiency to cut energy bills.

- 9:30 a.m. House Appropriations Interior-Environment Subcommittee hearing for fiscal 2023 Member Day.

- 9:30 a.m. Senate Armed Services Committee hearing on the fiscal 2023 budget request for defense.

- 10 a.m. House Appropriations Defense Subcommittee closed hearing – United States Special Operations Command

- 10 a.m. Senate Environment and Public Works Committee meeting on pending calendar business.

- 10 a.m. House Oversight Civil Rights and Civil Liberties Subcommittee hearing on book bans and academic censorship.

- 10 a.m. Senate Energy and Natural Resources Committee hearing on critical mineral demand and recycling.

- 10 a.m. Senate Finance Committee hearing on the fiscal 2023 budget request for the IRS as well as the 2022 filing season.

- 10 a.m. Senate Foreign Relations Committee hybrid hearing on several ambassador nominations.

- 10 a.m. House Committee on Economic Disparity and Fairness in Growth Roundtable with Native American Leaders.

- 1 p.m. House Natural Resources Water Subcommittee hybrid hearing on banning Russian seafood imports.

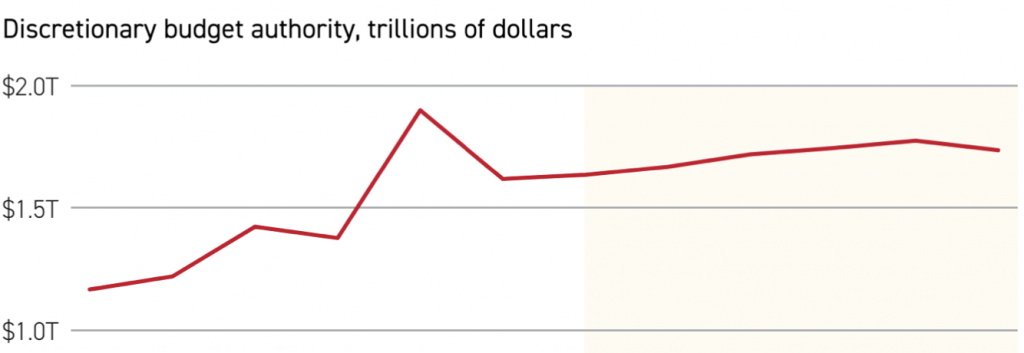

What you need to know about Budget Policy and the Midterms

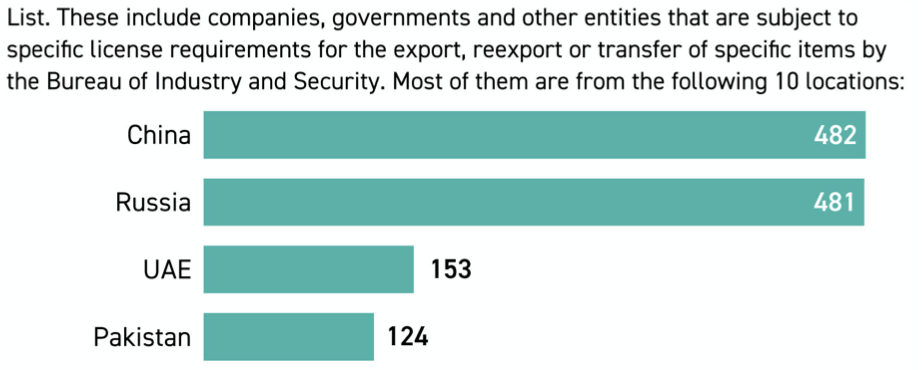

What you need to know about Export Controls

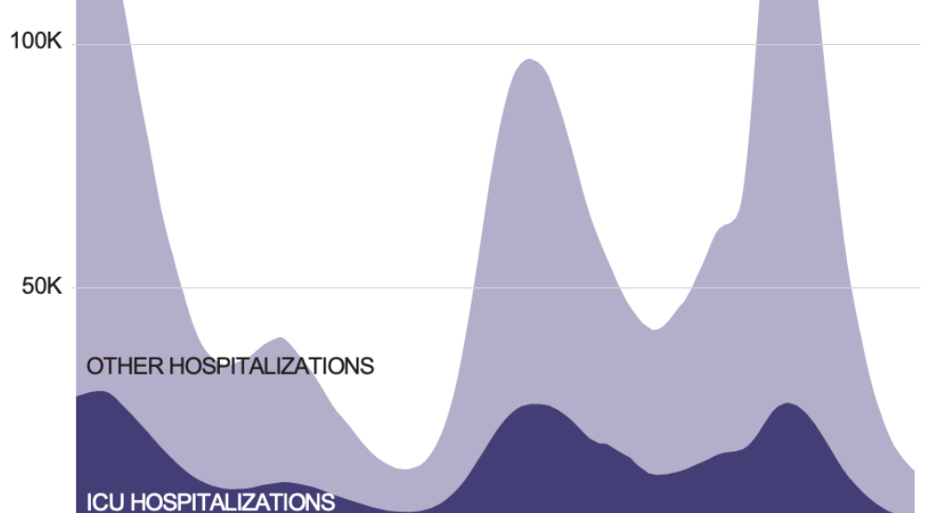

Majority of current Covid-19 cases are now BA2 Omicron subvariant

How Biden’s budget compares to Congress’ fiscal 2022 spending bill

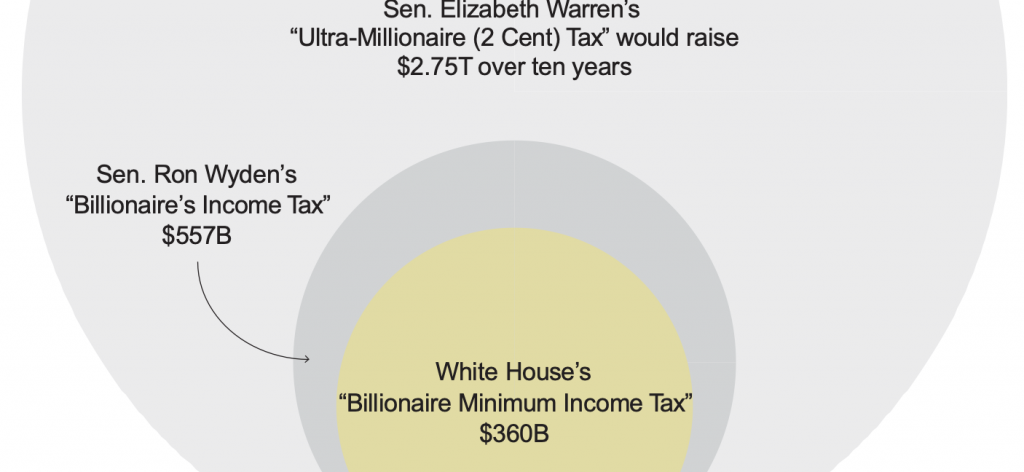

How Biden’s tax on the wealthiest Americans would raise $360 billion

Breaking down Biden’s $1-58T budget

What you need to know about Biden’s science agenda

Add comment