Latest news from Washington, D.C. produced by Total Spectrum/SGA exclusively for members of the Arizona Chamber of Commerce & Industry

More Info: Michael DiMaria | Partner and SW Regional Director | 602-717-3891 | [email protected]

Heard on the Hill covers the continuing and changing-by-the-minute story of the President’s traditional and social Infrastructure agenda. We also wade into the President’s 20-page executive order on competition. Congressman Erik Paulsen writes about six tax incentives that will play a major role in the President’s agenda. Steve Ruhlen brings us up to speed on the appropriations process for the 2022 fiscal year. Ramona Lessen reviews a recent House Small Business Agriculture and Rural Development Subcommittee hearing on economic recovery in rural America.

We will return on in two weeks on July 28thfor the next issue of This Week. Stay well.

Steve Gordon, Managing Partner

Heard on the Hill

By Steve Gordon, Total Spectrum Managing Director

The most important thing that happened in Washington over the July 4th recess was that nothing important happened.

Tourists took over the town. Most of us in Washington who spend our time on policy, politics, or both shut down our minds for a while and kicked back. Local restaurants were not busy because most Washingtonians left town, but the important thing was that restaurants, bars, and museums were open.

The 15-month pandemic was a confining and confusing time for most of us, and a terrible time for those who became a COVID statistic. Maybe we will not snap back immediately to the normal life we had before the pandemic. Maybe we find a new normal, maybe we are already there. Whatever it was and whatever you call it, kicking back a little felt pretty darn good.

President Biden’s leadership and legacy are on the line this summer.

As a candidate in the 2020 election, Joe Biden was projected as an experienced legislator who was used to working with his Republican and Democratic Senate colleagues. He stressed his knowledge of foreign affairs as the former chairman of the Senate Foreign Relations Committee, and he committed to getting COVID vaccines into Americans’ arms.

But in today’s base politics, those things are a good start – but only a start. The enthusiasm of the liberal and progressive base provided the energy for the campaign.

Now, President Biden is trying to project steadiness and calm while proposing a very expansive legislative agenda that plays to the base of his party. A midwestern Democrat told me recently that “Senator Biden watched both President Carter and President George H. W. Bush lose their base and then their reelection. There is no education in the second kick of the mule… and even less the third time.”

Working on traditional infrastructure through a bipartisan approach plays to the calm, steady, and predictable President. Working on social infrastructure plays to his base. Senate Majority Leader Schumer sent a Dear Colleague letter to his Democratic Caucus on July 9th in which he spoke about a two-track approach in July – a bipartisan traditional infrastructure bill and a resolution out of the Senate Budget Committee – setting the table for a social infrastructure bill which Democrats could try to pass this fall through the reconciliation process.

Some people on Capitol Hill will tell you that a traditional infrastructure bill costing somewhere between $600 billion and $1 trillion can be written by the bipartisan group of senators, and can get the votes of every Democrat and ten Republican senators. Just as many people on Capitol Hill will tell you why it will not happen. For example, some Senate Republicans – including a few of the moderates who negotiated the bill – are concerned about the fuzzy revenue numbers proposed to fund the bipartisan bill, others are concerned about raising taxes to help pay for the bill. Still others are torn between passing a traditional infrastructure bill that we certainly need that is part of the President’s agenda. Senate Minority Leader McConnell has not commented publicly on the bipartisan proposal.

Senator Bernie Sanders, Chairman of the Senate Budget Committee, proposed a budget resolution of $6 trillion for social infrastructure. Senator Mark Warner (D-VA), a moderate member of the Senate Budget Committee, felt that $3 trillion would be more like it. Senator Joe Manchin (D-WV) said Tuesday that the social infrastructure bill – whatever the number – must be paid for and should not be put on the country’s credit card.

Tuesday night, the Senate Budget Committee passed a resolution that included $600 billion for traditional infrastructure and $3.5 trillion in new spending for social infrastructure. Budget Committee Democrats propose to pay for their program in large part by raising taxes on corporations and individuals.

The budget resolution passed Tuesday night by the Budget Committee has not yet been written, but early details came out Wednesday. Included is a significant climate provision and funding to provide universal prekindergarten, childcare, and community college. The proposal also increased funding for historically black colleges and universities, paid family and medical leave, and new Medicare provisions. The revenue to pay for this agenda would come from three ‘buckets’: increasing corporate and international taxes, health savings by lowering prescription drug costs and by repealing the Trump Administration’s rebate rule, and from new taxes to be generated by anticipated long-term economic growth.

Again, the budget resolution has not been formally written yet, and it will take some time for it to go from bullet points to legislative language. Democrats can and ultimately will pass the resolution out of the Budget Committee on a party line vote, but the real work will be writing a budget resolution for social infrastructure that can be agreed to by each of the 50 Senate Democrats and House Democrats.

Senate Democrats are a long way from agreement and in an evenly divided Senate, every Democratic senator is a king or a queen – and every senator has leverage.

The calendar also counts. The legislative packages need to be written and vetted. A budget resolution will require about a week of Senate floor time, and any infrastructure bill will require two weeks of floor time. The target start date for the summer recess is August 9th, though Majority Leader Schumer is threatening to keep the Senate working beyond that date.

Majority Leader Schumer surprised many people this week by scheduling for next week the first procedural votes – technically a motion to proceed – on the bipartisan traditional infrastructure proposal. It is surprising because he knows full well that the bipartisan group of senators led by Senators Rob Portman (R-OH) and Kyrsten Sinema (D-AZ) have not finished agreeing to their proposal and then writing the bill.

The President’s legislative agenda and legacy hangs on how these two infrastructure bills do in Congress. I cannot see any Democratic senator being willing to be a final no vote on the social infrastructure bill that will be brought up through reconciliation, so I have four questions in my mind:

- Will the bipartisan group of Senators find a way to pay for their traditional infrastructure bill? The good news is that they are still talking, but they must agree on how they will pay for the program, and that is always a rocky road.

- If the bipartisan group of senators can find a way to pay for their traditional bill, will their proposal get the support of all 50 Democrats and 10 Republicans in the Senate? (Odds are less than 50-50.)

- If the bipartisan infrastructure bill fails in the Senate, Democrats will include traditional infrastructure in their final budget resolution, thereby recoupling the President’s original proposal. The amount to be spent in that resolution will be decided through the push and pull of party moderates and party progressives and liberals. (The end number will almost assuredly more than $2 trillion, and will go up to the point where moderate Democrats will not spend any more.)

- Congress has about four weeks and change until the scheduled start of the August recess. The Budget Act will take up a lot of time on the Senate floor, and there will be amendments aplenty. Look for a vote on the budget right before the start of the August recess, committee activity in the fall, and a final reconciliation bill sometime this fall.

The Debt Ceiling

The COVID relief legislation of the last two years has put additional pressure on raising the debt ceiling, which will need to be raised around August 1st. But the Treasury Secretary traditionally finds loose change between the sofa cushions that will delay a vote to sometime in September. Most if not all Republicans will not vote to raise the debt ceiling, so it will be up to Majority Leader Schumer and Senate Democrats.

The President’s Executive Order on Promoting Competition in the American Economy

On July 9th, the White House issued a 20-page executive order designed to foster competition in labor, healthcare, transportation, agriculture, internet, technology, and banking/finance. It is a lengthy document, and an important one. But what is not clear is why the package was released on Friday – a traditionally bad day to release press releases if you want maximum exposure.

The White House’s fact sheet on the executive order is available here. We will review the details of the executive order and provide more information in an upcoming Heard on the Hill.

Appropriations Update

By Steve Ruhlen, Total Spectrum Partner

Congress is marching through its annual appropriations process, putting together the dozen bills that provide for federal spending for fiscal year 2022, which starts October 1. The House Appropriations Committee this week considered several of these bills, hoping to meet the goal of House Democratic leadership to pass all twelve government funding bills before the August recess.

Two factors complicate the outlook for the appropriations process: the $600 billion infrastructure bill being considered in the Senate, and Democrats’ efforts to approve trillions in additional spending via a partisan legislative strategy.

Given the jockeying over the infrastructure deal and the possibility of trillions in additional spending outside of the appropriations process, the House postponed consideration of its annual budget resolution – which spells out specific categorical spending limits – and instead passed in June a general topline spending limit of $1.5 trillion for FY2022. This was a $200 billion increase from the FY2021 topline.

The Senate appropriations timeline is more delayed. With a 50-50 Democrat-Republican split in the Senate, it will be hard to get approval for many of the funding levels and policy initiatives that are expected to be included in the appropriations bills that pass in the Democrat-controlled House. For example, House Democrats are expected to remove several bans on federal funding for abortions, increase the Education Department spending by over 40%, increase Labor Department spending by nearly 20%, and keep defense spending essentially flat.

Keep in mind, however, that while the Democrats control the House, they only have a five-vote margin over the Republicans, so passage of any highly controversial spending bills is not assured.

The outcome of the still ongoing infrastructure negotiations in the Senate and the potential of Democrats to push through several trillions in additional spending through the reconciliation process are muddying the appropriations outlook.

While House appropriators are looking to boost transportation spending by $17 billion over the Biden Administration’s budget recommendation, it is still not clear how much of the total transportation appropriations would be covered in the infrastructure package – a deal for which details are currently being hashed out in the legislative process. And although 11 Republican senators previously signaled support for the framework of the infrastructure agreement, some have said they won’t be on board if the President and congressional Democrats try to ram though trillions in additional spending on a separate reconciliation bill through a party line vote.

Reconciliation is a legislative procedure that could allow congressional Democrats to pass massive increases in social spending on their own. Reconciliation cannot be filibustered in the Senate, meaning it – as opposed to other bills that come before the Senate – would only need a majority of 51 votes to pass, with Vice President Harris casting the tie-breaking 51st vote.

The first step in the reconciliation process requires both the House and Senate to pass a budget plan for FY2022. This week, the Senate Budget Committee introduced a $3.5 trillion spending plan that Democratic leadership believes will fund their social spending priorities. It is not the $6 trillion plan that many Democrat progressives, including Senate Budget Committee Chairman Bernie Sanders, wanted. It is expected that the President’s calls for two years of free community college, increasing the child tax care credit, subsidies for childcare, and paid leave will be in the budget proposal. The House is expected to follow suit, with both bodies looking to pass a final budget resolution before the August recess.

Senate Majority Leader Schumer still needs to ensure the support of all his Democratic senators. With an evenly divided Senate, passage of the $3.5 trillion reconciliation package is not a done deal. Senators Joe Manchin (D-WV) and Kyrsten Sinema (D-AZ) have expressed concerns about using the reconciliation process to pass any massive controversial spending plan on a party line vote, and Sen. Manchin said that the budget proposal will need to be paid for and not rely on deficit spending.

Senate Majority Leader Schumer announced this week that he wants to move forward with the infrastructure bill and hold a necessary procedural vote next Wednesday. Republicans question how Leader Schumer can expect to advance a bill when there is no legislative language and no firm agreement on the specifics of the bill. Seeing that it would require 60 votes to clear the procedural hurdle – needing at least ten Republicans to join in support – many Republicans see Schumer’s maneuver as a deliberate attempt to sink the bill, blame Republicans for its demise, and then wrap it into a reconstituted reconciliation bill which they hope to pass on a party line vote.

Democrats enjoy control of the White House, the House, and the Senate, but they must reconcile the strong push for additional spending from their considerable progressive base with extremely slim majorities on both sides of Congress. The implications of this year’s appropriations process, the infrastructure negotiations, and the potential of huge social spending through the reconciliation process will almost certainly reverberate into next year’s midterm elections.

President Biden’s Proposed Clean Energy and Community Development Tax Incentives Will Play a Major Role in his Infrastructure Plan

By Congressman Erik Paulsen, Total Spectrum Strategic Consultant

President Biden’s $2.3 trillion American Jobs Plan released in March includes a number of community development and clean energy tax incentives which build upon existing incentives that have traditionally enjoyed bipartisan support. Examples of these include an expansion of the low-income housing tax credit, creation of a neighborhood homes investment tax, permanence for the new markets tax credit, authorization of new tax-exempt bonds for schools and infrastructure, extensions and enhancements of the renewable energy production and investment tax credits, and extensions and modifications of the energy efficiency tax incentives.

President Biden also proposes in the American Jobs plan to repeal all tax credits, deductions and other special provisions that aim to encourage oil, gas, and coal production. Eliminating tax incentives to produce fossil fuels is a fundamental goal of Congressional progressives.

Almost all Republicans in Congress believe in an “all the above” approach to energy production and support incentives to produce both renewable energy and energy from fossil fuels. Any bill put up by Senate Democrats that includes the President’s infrastructure and clean energy tax incentives but eliminates fossil fuel tax incentives will be filibustered by Republicans.

That is exactly why Senate Democrats will try to unite their caucus and pass this legislation – including the Biden tax rate increases – through the budget reconciliation process, which allows certain bills to be passed with a simple majority and cannot be filibustered.

Below, my summary of the tax credits that will receive the greatest attention:

Expansion of the Low-Income Housing Tax Credit

The Biden Administration proposes to significantly expand this credit to incentivize affordable rental housing development in high opportunity areas. This proposal would create an additional allocation of low-income housing tax credits for these areas, which would be based on a formula that would take into consideration the cost of constructing and operating affordable housing.

The New Neighborhood Homes Investment Tax Credit

There are currently no federal tax provisions that directly support building or renovating owner-occupied housing. The Biden Administration’s proposal would create the Neighborhood Homes Investment Tax Credit, which would provide approximately $2 billion in credit authority to support new construction and substantial rehabilitation for existing homeowners. It would be allocated to states with an emphasis on populations living in distressed urban, suburban, or rural neighborhoods.

The New Markets Tax Credit

This tax credit is for qualified equity investments made to acquire stock in a corporation, or a capital interest in a partnership, that is a qualified community development entity. The credit totals 39% of the original investment and can be claimed over seven years. The Biden proposal would permanently extend the New Markets Tax Credit and allow community development entities to continue generating investments in low-income communities, but now with greater certainty.

Schools and Infrastructure

It is generally agreed we need to renovate some older educational facilities and to encourage the construction of new structures. This proposal would create tax-exempt School Infrastructure Bonds, which would be similar to the Build America Bonds that were authorized under the Obama Administration. The proposal would authorize up to $50 billion in these bonds, with $16.7 billion authorized in each of 2022, 2023, and 2024.

The proposal would also expand the category of private activity bonds by allocating an additional $15 billion for use by the Secretary of Transportation. The proposal would allow private activity bonds to be issued for public transit, passenger rail, and infrastructure for zero emissions vehicles.

Extend and Enhance the Production Tax Credit and the Investment Tax Credit

The Renewable Energy Production Tax Credit would be extended in its entirety for projects that begin construction after December 31, 2021, and before January 1, 2027. Beginning in 2027, the credit rate would begin to phase down to zero over five years.

The Renewable Energy Investment Tax Credit, much like the Production Tax Credit, would be extended for 1) solar and geothermal electric energy property; 2) qualified fuel cell power plants; 3) geothermal heat pumps; 4) small wind properties; 5) offshore wind properties; 6) waste energy recovery properties; and 7) combined heat and power properties. Starting in 2022, the Renewable Energy Tax Credits would be expanded to include stand-alone technology that stores energy for conversion to electricity and has the capacity of not less than five kilowatt hours.

Taxpayers would have the option to receive a cash payment instead of a credit from either the Production Tax Credit or the Renewable Energy Investment Tax Credit. The Department of the Treasury has not specified the amount of the cash payment or how that option might work. This promises to be an area where intense input from policy makers will be needed.

New Electricity Transmission Tax Credit

The proposal would provide a credit equal to 30% of a taxpayer’s investment in qualifying power transmission property placed in service in any given year. Qualifying electric power transmission property would include overhead, submarine, and underground transmission facilities meeting certain criteria, including a minimum voltage of 275 kilovolts and a minimum transmission capacity of 500 megawatts. Qualifying property would also include any ancillary facilities and equipment necessary for the proper operation of the transmission facility. This new credit also has a direct pay option. The New Electricity Transmission Tax Credit would be effective for property placed in service after December 31, 2021, and before January 1, 2032.

The current discussions on potential infrastructure legislation have focused thus far on the definition of infrastructure, its cost, and how it would be financed. But the tax issues related to community development, clean energy, and fossil fuels will soon take center stage. Both the Senate Finance Committee and the House Ways and Means Committee have started assembling the proposed legislation.

I would be pleased to visit with anyone who has questions; I can be reached via email by clicking on my name above.

Hearing Report

By Ramona Lessen, Total Spectrum Executive Director

House Small Business Agricultural and Rural Development Subcommittee hearing on the economic recovery efforts in rural America

Tuesday, July 13, 2021; 1:00 p.m.

To view a livestream of the hearing please click here.

Congressman Jared Golden (D-ME-2nd)

Majority Statement

Congressman Roger Williams (R-TX-25th)

Minority Statement

Witnesses:

Mr. Nathan Ohle

Chief Executive Officer

Rural Community Assistance Partnership

Washington, DC

Testimony

Ms. Jessica Campos

Women’s Business Center Director

Center for Rural Affairs

Lyons, NE

Testimony

Mr. Brett Challenger

Senior Vice President of the Regional Agribusiness Banking Group

CoBank

Greenwood Village, CO

Testimony

Mr. Alan M. Crawford

Owner and President

Rangaire Manufacturing Company

Cleburne, TX

Testimony

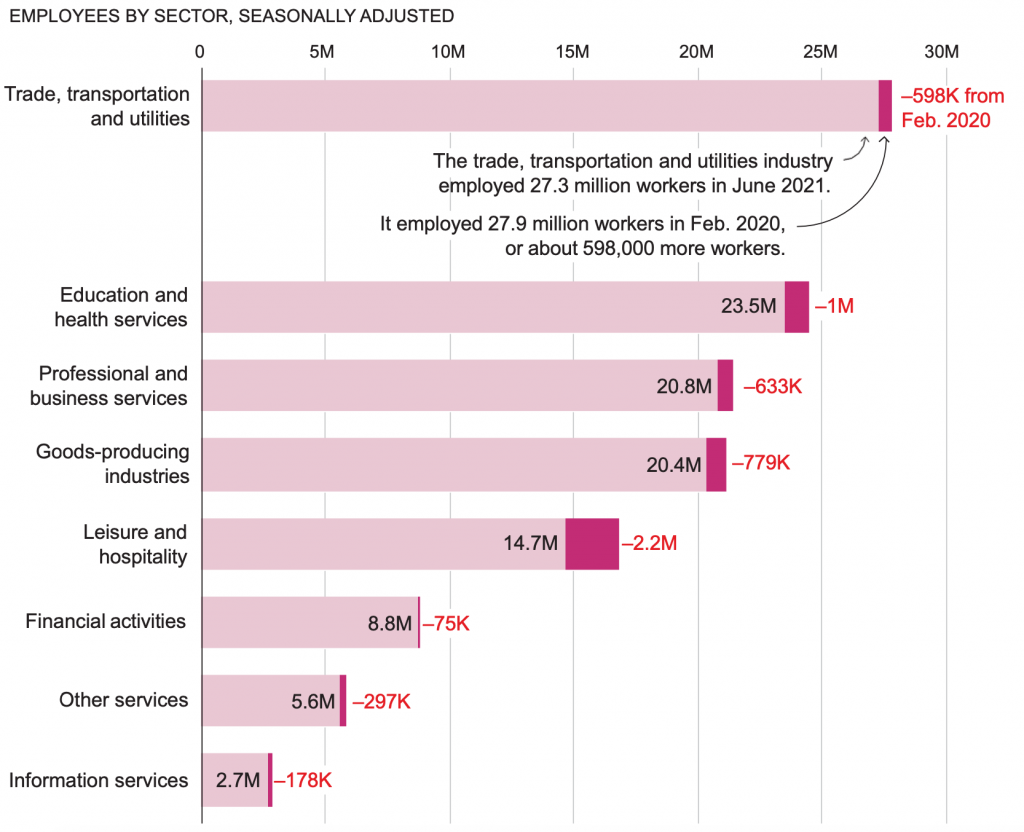

BLS data shows Covid still affecting service and other sectors

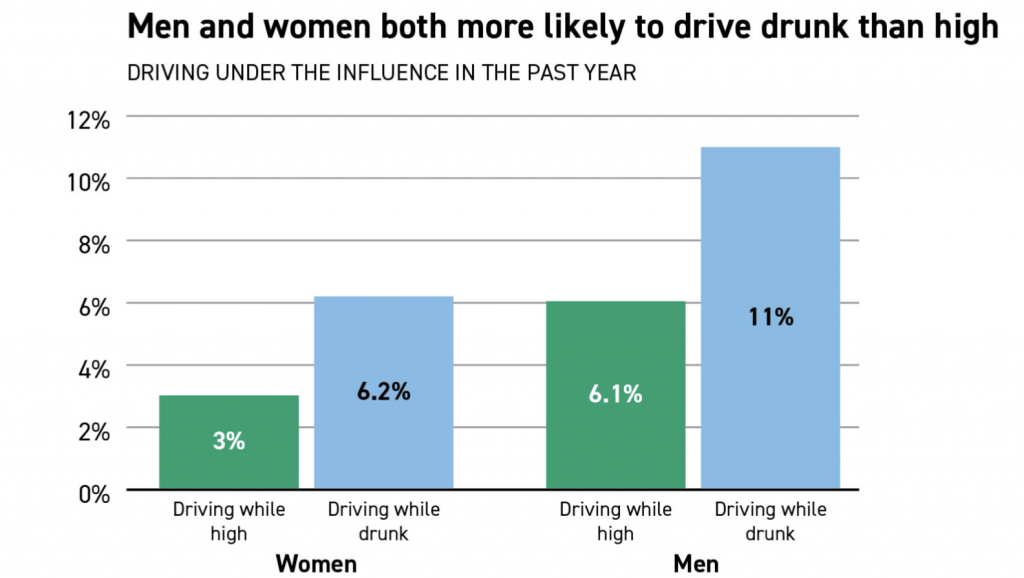

What you need to know about Drugged Driving

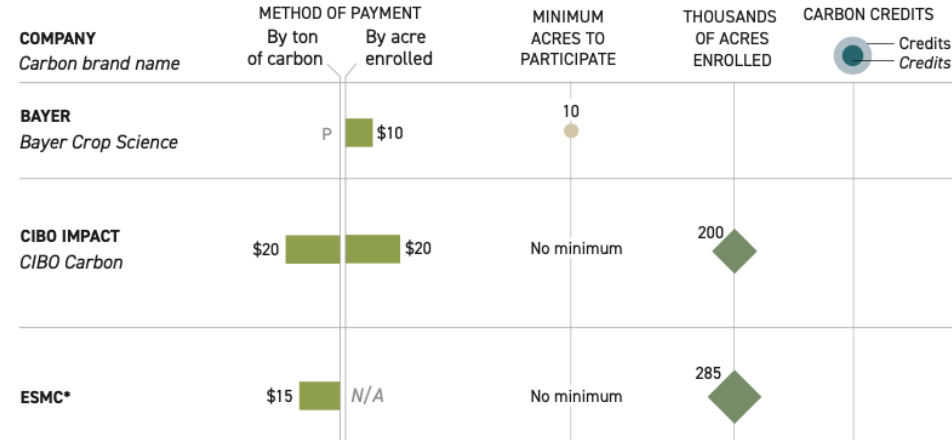

Companies scramble to enter the cropland carbon marker

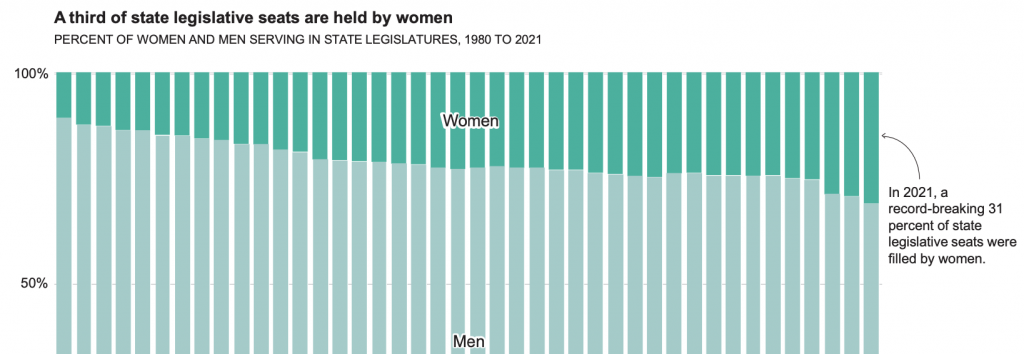

A record number of women are serving in state legislatures

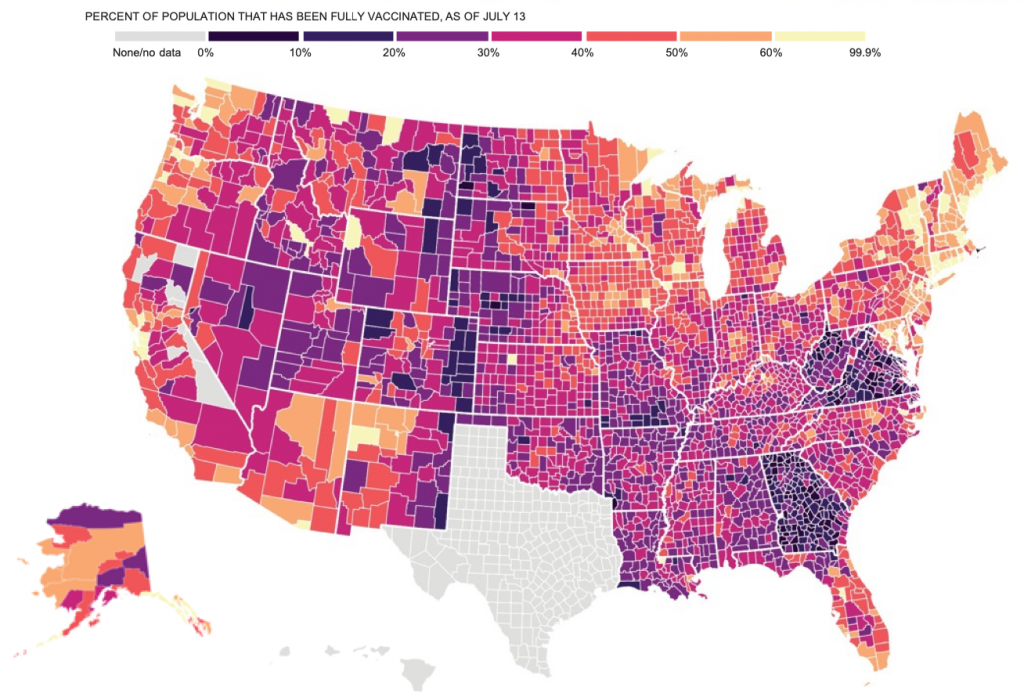

Vaccine tracker: 67.8% of U.S. adults have received first dose

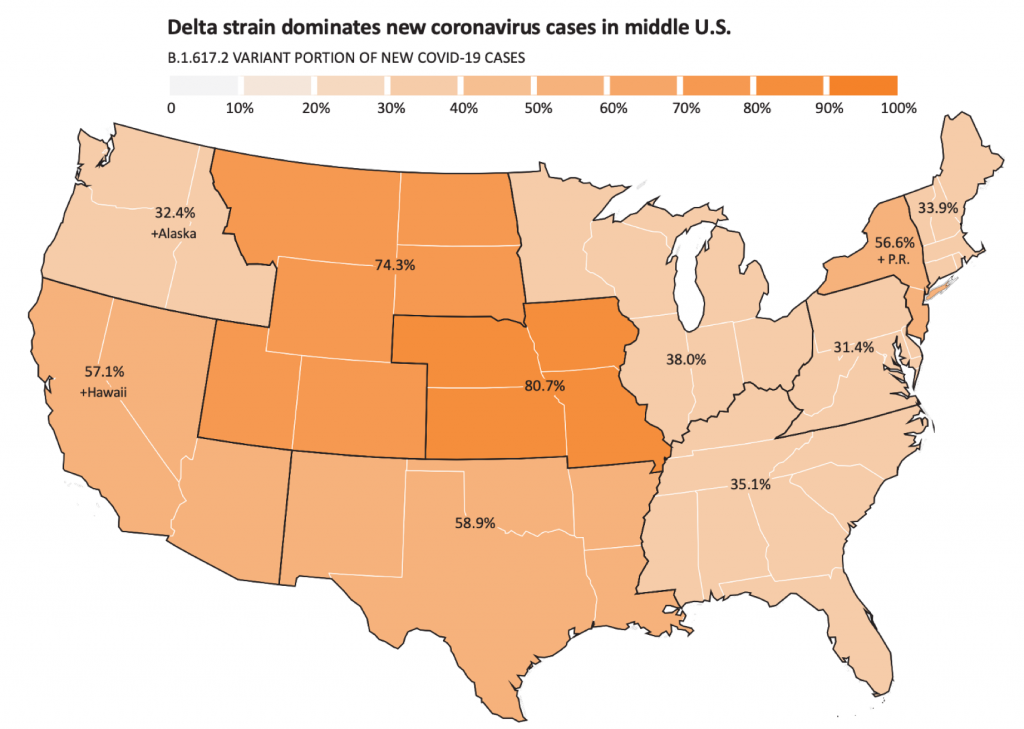

Delta variant causing more than half of new U.S. coronavirus cases

Congressional Calendar

All times EDT

Monday, July 12, 2021

- 10 a.m. House Judiciary Courts-IP-Internet Subcommittee virtual hearing on diversifying the federal judiciary.

- 11 a.m. House Appropriations Labor-HHS-Education Subcommittee markup of the Labor-HHS-Education spending legislation for fiscal 2022.

- Noon. House Agriculture Oversight Subcommittee virtual hearing on SNAP benefits.

- 1 p.m. House Administration Committee virtual hearing on the Elections Clause of the Constitution.

- 1 p.m. House Appropriations Energy-Water Development Subcommittee markup of the Energy-Water Development budget proposal for fiscal 2022.

- 3 p.m. House Appropriations Commerce-Justice-Science Subcommittee markup of the Commerce-Justice-Science budget bill for fiscal 2022.

- 5 p.m. House Appropriations Transportation-Housing-Urban Development Subcommittee markup of the Transportation-Housing-Urban Development budget proposal for fiscal 2022.

- 6 p.m. Senate Foreign Relations Committee closed hearing – S. J. Res. 10: Repeal of the 1991 and 2002 Authorizations for Use of Military Force as well as Discussion of Recent US Military Strikes in Iraq and Syria.

Tuesday, July 13, 2021

- 9:30 a.m. Senate Armed Services Committee hearing to examine five pending nominations for the Department of Defense.

- 10 a.m. House Judiciary Subcommittee on Crime, Terrorism, and Homeland Security hearing – Facial Recognition Technology: Examining Its Use by Law Enforcement.

- 10 a.m. House Veterans Affairs Disability Assistance and Memorial Affairs Subcommittee virtual hearing to discuss efforts to modernize the VA appeals program.

- 10 a.m. Senate Banking Committee hearing on the nominations of Arun Venkataraman to be assistant secretary of Commerce and director general of the Foreign Commercial Service and Damon Smith to be HUD general counsel.

- 10 a.m. Senate Foreign Relations Committee hearing to examine four pending nominations for the Department of State.

- 10 a.m. Senate HELP Committee hearing to examine three pending nominations for the Department of Education.

- 10 a.m. House Appropriations Committee markup of the proposed Defense and Homeland Security spending bills for fiscal 2022.

- 11 a.m. House Energy and Commerce Committee virtual business meeting for a member day.

- 11:30 a.m. Senate Small Business and Entrepreneurship business meeting to consider the nomination of Dilawar Syed to be deputy administrator of the Small Business Administration.

- 1 p.m. House Natural Resources National Parks, Forests and Public Lands Subcommittee virtual hearing to examine five bills, including H.R. 3132 (117), which would reauthorize the Lake Tahoe Restoration Act.

- 1 p.m. House Small Business Agricultural and Rural Development Subcommittee virtual hearing on economic recovery efforts in rural America.

- 2 p.m. House Judiciary Subcommittee on Immigration and Citizenship hearing– Oh Canada! How Outdated US Immigration Policies Push Top Talen to Other Countries.

- 2 p.m. House Veterans Affairs Oversight Subcommittee virtual hearing on modernizing the VA police force and boosting accountability.

- 2 p.m. Senate Appropriations Committee hearing to examine Biden’s proposed fiscal 2022 budget for the USPS Office of Inspector General and USPS service issues. 138 Dirksen.

- 2:30 p.m. Senate Judiciary Antitrust and Competition Subcommittee hearing on anti-competitive behavior among prescription drug companies. 226 Dirksen.

- 3 p.m. House Armed Services Airland Subcommittee virtual hearing to discuss provisions in the fiscal 2022 defense spending proposal for the Fixed-Wing Tactical and Training Aircraft Program.

Wednesday, July 14

- 9:15 a.m. Senate Homeland Security Committee business meeting to consider 15 bills, including S. 1917 (117), which would establish a K-12 education cybersecurity initiative.

- 9:45 a.m. Senate Environment and Public Works Committee business meetingto consider the nominations of Jane Nishida to serve as assistant administrator for international and tribal affairs of the Environmental Protection Agency, Jeffrey Prieto to be general counsel of the EPA and Alejandra Castillo to be assistant secretary for economic development of the Department of Commerce. The meeting will immediately be followed by a hearing to examine the nomination of Michael Connor to be an assistant secretary of the army for civil works at the Defense Department.

- 10 a.m. Senate Energy and Natural Resources Committee business meeting to consider energy infrastructure legislation by Chair Sen. Joe Manchin (D-W.Va.).

- 10 a.m. Senate Appropriations Labor-HHS-Education Subcommittee hearing to examine Biden’s proposed fiscal 2022 budget for the Department of Labor. Sec. of Labor Marty Walsh testifies.

- 10 a.m. Senate Judiciary Committee hearing to examine pending nominations.

- 10:30 a.m. Senate Foreign Relations Committee hearing to examine Biden’s fiscal 2022 budget request for USAID. USAID Administrator Samantha Power testifies.

- 11 a.m. House Transportation and Infrastructure Water Subcommittee hearingon Biden’s fiscal 2022 budget request.

- 11:30 a.m. House Energy and Commerce Subcommittees on Energy and the Environment and Climate Change hearing – “Keeping US Safe and Secure: Oversight of the Nuclear Regulatory Commission.”

- Noon. House Financial Services Committee virtual hearing on monetary policy and the state of the economy. Federal Reserve Chair Jerome Powell testifies.

- Noon. House Agriculture Committee business meeting to consider HR 4374, the Broadband Internet Connections for Rural American Act.

- 2 p.m. House Foreign Affairs Committee virtual hearing on the Biden administration’s foreign assistance priorities and the fiscal 2022 USAID budget request.

- 2 p.m. House Veterans Affairs Health Subcommittee virtual hearing on nine bills, including H.R. 913, the Build a Better VA Act.

- 2:30 p.m. Joint Economic Committee virtual hearing to examine corporate power in the U.S.

- 2:30 p.m. Senate Judiciary Constitution Subcommittee hearing on restoring the Voting Rights Act after the Supreme Court’s Brnovich and Shelby County decisions.

- 2:30 p.m. Senate Indian Affairs Committee business meeting to consider the nomination of Bryan Todd Newland to be assistant secretary of Indian affairs for the Interior Department. The meeting will be immediately followed by a legislative hearing to consider three bills, including H.R. 1688 (117), which would amend the Indian Child Protection and Family Violence Prevention Act.

- 3:30 p.m. Senate Veterans’ Affairs Committee hearing on modernizing the VA’s electronic health records.

- 4 p.m. House Armed Services Subcommittee on Readiness hearing – FY22 Budget Request for Military Construction, Energy, and Environmental Programs.

Thursday, July 15

- 9 a.m. Senate Judiciary Committee business meeting to consider the nominations of Eunice Lee to be United States Circuit Judge for the 2nd Circuit, Veronica Rossman to be United States Circuit Judge for the 10th Circuit, and David Estudillo, Lauren King and Tana Lin to each be a United States District Judge for the Western District of Washington.

- 9:30 a.m. Senate Aging Committee hearing on savings opportunities for elderly Americans.

- 9:30 a.m. Senate Agriculture Committee hearing on the nomination of Jennifer Lester Moffitt to be undersecretary of Agriculture for marketing and regulatory programs.

- 9:30 a.m. Senate Banking Committee hearing on the semiannual monetary policy report to Congress.

- 10 a.m. Senate Commerce Committee hearing on supply chain resiliency.

- 10 a.m. Senate HELP Committee hearing to examine the nominations of David Weil to be administrator of the Wage and Hour Division at the Department of Labor and Gwynne Wilcox and David Prouty to both join the National Labor Relations Board.

- 10:15 a.m. Senate Homeland Security Committee hybrid hearing to examine the nominations of Robert L. Santos to be director of the census and Ed Gonzalez to be an assistant secretary of Homeland Security.

- Noon. House Homeland Security Committee virtual hearing on reform efforts within DHS.

- House Financial Services Subcommittee on Oversight and Investment hearing– CDBG Disaster Recovery: States, Cities and Denials of Funding.

- 1 p.m. House Natural Resources Subcommittee on Oversight and Investigations hearing – Oversight: Are Toxic Chemicals From Tires and Playground Surfaces Killing Endangered Salmon?

- 2:30 p.m. House Climate Crisis Select Committee virtual hearing on environmental justice.

Friday, July 16

- 9 a.m. House Appropriations Committee markup of the Energy-Water Development and Transportation-Housing-Urban Development budget proposals for fiscal 2022.

- 10 a.m. House Homeland Security Subcommittee on Emergency Preparedness, Response, and Recovery hearing – DHS Management.

- 12 noon. House Financial Services Committee Task Force on Artificial Intelligence hearing: Verifying Identity While Preserving Privacy in the Digital Age.

- 1 p.m. House Judiciary Constitution, Civil Rights and Civil Liberties Subcommittee virtual hearing on the Supreme Court’s Brnovich v. DNC decision and potential legislative responses.

Add comment