More Info: Michael DiMaria | Partner and SW Regional Director | 602-717-3891 | [email protected]

Thanks for your interest in Washington, and thanks for reading This Week in Washington.

There is nothing generating more interest and more intensity in Congress right now than President Biden’s $2.3 trillion infrastructure proposal and the equally massive corporate tax increase that Democrats want to pay for their plan. I asked Patrick Robertson to summarize some of the corporate tax changes Democrats are talking about as part of this infrastructure proposal – and then to tease us with some of the changes to the individual tax code that are being discussed for their next legislative agenda.

Al Jackson brings us up to date on defense issues, and Ramona Lessen highlights two Senate hearings: one before the Senate Finance Committee to consider the nominations of Andrea Joan Palm to be Deputy Secretary of Health and Human Services and Chiquita Brooks LaSure to be Administrator of the Centers for Medicare and Medicaid, and a second of the Senate Appropriations Committee focused on the American Jobs Plan, infrastructure, climate change, and America’s future.

Congressman Kevin Brady, former Chairman of the House Ways and Means Committee and now the committee’s Ranking Member, recently announced his retirement from Congress at the end of 2022. Congressman Erik Paulsen served with Congressman Brady and they were housemates in Washington. Erik wrote a wonderful short article about his friend, colleague, and mentor Congressman Brady – which I am sure you will enjoy.

I also want to introduce you to Blake Fulenwider, our newest Total Spectrum partner. Blake has spent more than a decade creating and administrating health care policy both for a Georgia Congressman and two Georgia Governors – and he was supremely successful as a healthcare advocate and consultant during his first stint with us. Blake will be Total Spectrum Georgia’s Chief Health Policy Advisor, but he will have a national reach and we will feature articles from him in future issues of This Week.

Total Spectrum Spotlight focuses on Senator Shelley Moore Capito, Republican of West Virginia. Senator Capito serves on four Committees – Appropriations; Commerce, Science, and Transportation; Environment and Public Works where she is the Ranking Member; and Rules and Administration. She is point person on assembling the Republican response to the administration’s infrastructure proposal and is recognized for her legislative reach and effectiveness. Congressman Erik Paulsen served with Shelley Moore Capito in the House of Representatives and they have a wonderful discussion as former colleagues and friends.

We will be back in two weeks with the next issue of This Week in Washington. Stay well, and thanks again.

Stay well.

Steve Gordon, Managing Partner

Washington Whispers

By Patrick Robertson, Total Spectrum Strategic Consultant

“Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.”

This quote from Benjamin Franklin, a year before his death, in a letter to French scientist Jean-Baptiste Le Roy was meant as a commentary on the permanence of the U.S. Constitution, but it has evolved into commentary on the permanence of both death and taxes.

Talking about death is not my bailiwick, so I will focus today on taxes, but there is an intersection later in this article on the estate tax. The one thing that has changed dramatically since 1789 is how much we legislate through the tax code – both to encourage or discourage certain behaviors, not to mention how we raise revenue.

Tax has become one of the leading topics of conversation in Washington in recent weeks as President Biden released his Made in America Tax Plan, intended to help pay for his massive infrastructure proposal. But in Washington spending is always easy but paying for it is the hard part. The bottom line is that the current federal revenue stream will not support $2 to $4 trillion in new infrastructure spending over the next 10 years, so the federal government will either need to cut spending elsewhere or raise more revenue through the tax code.

Steve Gordon discussed the administration’s goals for the infrastructure bill and gave an overview of their plan to pay for this program in the April 7th issue of This Week in Washington.

Looking more closely at the Made in America Tax Plan, it is no surprise that the administration chose to increase taxes on corporations rather than cut other government spending. The Biden plan raises a number of taxes on corporations, both directly and through a major shift in the international tax regime. In summary it would:

- Raise the corporate tax rate to 28%, up from the current 21%;

- Raise the tax on Global Intangible Low Tax Income (GILTI) to 21%. eliminate the exemption of a 10% return on an investment abroad and calculate GILTI on a country-by-country basis;

- Impose a 15% tax on book income, levied on profits instead of taxable income (only for companies with revenues over $100 million);

- Create a tax credit for bringing jobs back to the U.S. and deny deductions for moving jobs overseas;

- Increase corporate tax enforcement;

- Eliminate some deductions and credits for the fossil fuel industry; and

- Repeal the Foreign-Derived Intangible Income (FDII) deduction.

Some of these proposals overturn the Trump tax law and others are changes long sought by those who think corporations should pay more on their earnings overseas. The most important thing to note is that this is the high-water mark for most of these proposals.

A cadre of Senate Democrats has already come forward to say they do not want the corporate rate to go 28%, so my advice is to assume the highest new corporate rate will be 25%. Senate Democrats will either need to stick together and pass the plan through budget reconciliation – the same way they passed The American Rescue Plan earlier this year – or pass a bipartisan bill with the support of at least 10 Senate Republicans.

Almost every Senate Republican has already said that they will not support major tax increases. So, in short, the administration faces the decision to pursue a smaller, more narrow, bipartisan infrastructure bill or go big and use budget reconciliation to pass both the spending and tax pieces of the plan.

There will be discussion on a variety of technical issues, and tax professionals in Congress and the Biden administration will really hold sway over their inclusion in this bill. If your business is impacted by a technical issue, it will be important for you to engage – and candidly, sooner rather than later.

A report on the proposed increases in corporate taxes was formally released several weeks ago by the Department of the Treasury. During the campaign, the Biden team also spoke about an increase in individual rates for wealthy individuals, and we can expect those proposed changes will be released in the future to pay for the second part of the administration’s major legislative agenda. Several liberal Democratic Senators have recently introduced a handful of bills that reflect parts of the Biden campaign’s positions on increasing taxes on individuals.

Senator Elizabeth Warren (D-MA) introduced a wealth tax, imposing a 2% tax on individual net worth above $50 million and an additional 1% surtax on net worth above $1 billion.

A few Democratic Senators have produced bills that would make changes in the estate tax, such as:

- Cut the estate tax exemption from its current $11.7 million to $3.5 million and reduce the gift tax allowance to $1 million (Sen. Bernie Sanders (I-VT) 99.5% Act).

- Create a progressive tax regime for estates: 45% for estates $3.5 million- $10 million, 50% for estates between $10 million and $1 billion, and 65% for estates over $1 billion (Sen. Bernie Sanders (I-VT) 99.5% Act).

- Tax unrealized capital gains at death with a $1 million exemption for smaller estates, allow up to 15 years to pay the tax, and provide for a deduction against the estate tax for any taxes paid and a $500,000 exemption for personal residences (Sen. Chris Van Hollen STEP Act). This step-up in basis would ensure assets do not forgo taxes when they are transferred in an estate. There is an exemption in this plan for assets held in a retirement account.

In addition, many Senate Democrats have proposed moving the top personal income tax rate back to 39.6%, the level before the Trump tax bill lowered that rate to 37%, as well as normalizing capital gains and ordinary income rates. The Biden campaign said these changes would only affect “the rich.” Presently, the income tax change is proposed to be on income over $400,000 and the capital gains rate changes would be for those making more than $1 million a year.

These proposed changes to individual and estate taxes – like the proposed corporate tax changes – are likely the high-water mark. It is highly probable that if Democrats pursue these tax changes they will be softened by the politics of the House and Senate.

There is also a significant faction of Democrats who are looking to reverse the elimination of the $10,000 cap on the deductibility of state and local taxes (SALT). The fate of that provision is uncertain.

As you can see, there is a great deal in play on the tax front, and I did not even mention direct pay for renewable credits, increased incentives for electric vehicles, improvements to the community development tax credits, and so many other items in the tax code that are currently being discussed.

Many potential tax increases are on the table, as well as new and enhanced incentives. The one thing for sure is that tax planners and tax professionals are going to be very busy.

Total Spectrum Spotlight: United States Senator Shelley Moore Capito

Congressman Erik Paulsen and Senator Shelley Moore Capito (R-WV) discuss her views on the scope of infrastructure, including broadband deployment. She explains the role Republicans may play in shaping the infrastructure proposals to fund these investments, and the possible return of earmarks. Senator Capito also provides insight into the ever-contentious Senate filibuster rule.

Blake Fulenwider: Total Spectrum’s New Partner and Chief Health Policy Advisor

By Steve Gordon, Total Spectrum Managing Partner

I am very pleased to announce that Blake Fulenwider has returned to Total Spectrum and will be a Partner and Total Spectrum Georgia’s Chief Health Policy Advisor.

Blake gained extensive experience as a consultant and healthcare advocate during his first stint at Total Spectrum. He also has served in senior leadership positions for a Georgia congressman and two Georgia governors, and has more than a decade of experience creating and administrating federal and state government healthcare policy.

He spent the last three years as Chief Health Policy Officer for the Georgia Department of Community Health (DCH). Blake was responsible for oversight and administration of the Division of Medical Assistance Plans – Medicaid, the Children’s Health Insurance Program (CHIP), the State Benefit Plan, the Office of Health Analytics and Reporting, and the Office of Continuous Program Improvement. These programs comprise over 98% of the DCH’s budget and provide healthcare for one in four Georgians.

As Chief Health Policy Officer, Blake was directed by Georgia Governor Brian Kemp to develop and implement innovative waivers to address accessibility, affordability, and the quality of healthcare. Blake worked with the Governor’s office to draft, submit, negotiate, and ultimately gain approval from the federal government for two novel waivers to the Patients First Act. These groundbreaking waivers are currently being implemented and serve as a model for the nation.

Blake was Deputy Commissioner of the Georgia Department of Community Health in the Administration of former Governor Nathan Deal. In this capacity, Blake successfully completed the first comprehensive reorganization of the agency’s Medicaid division in over 20 years.

He first earned his policy chops as then-Congressman Deal’s health policy advisor. There he led the Congressman’s agenda for the management of the Patient Protection and Affordable Care Act (PPACA), food safety modernization, the establishment of a biosimilar drug approval pathway, CHIP reauthorization and Congressional response to the 2009 H1N1 influenza pandemic.

Blake Fulenwider is a well-known and respected voice for healthcare policy among federal and state executive branch officials, members of Congress and the Georgia General Assembly, stakeholders and advocates across the nation. While he will be based in our Georgia office, his reach will be national.

A few words about former House Ways and Means Chairman Kevin Brady

By Congressman Erik Paulsen, Total Spectrum Strategic Consultant

Last week Kevin Brady, one of the smartest legislators and most gracious gentlemen in Congress, announced his retirement. As the top Republican on the House Ways and Means Committee – widely considered the most powerful committee in Congress due to its broad jurisdiction over tax writing, health care, trade, and Social Security issues – Congressman Brady’s most significant achievement was shepherding the 2017 Tax Cuts and Jobs Act, the biggest tax reform in a generation.

Congressman Brady is well-known for his policy chops and institutional knowledge of complex issues like the tax code. He played a major role securing many of our new trade agreements, including the new U.S.-Mexico-Canada (USMCA) renegotiation of NAFTA and helped author important health care reforms like last year’s ban on surprise medical bills. As a former head of a local chamber of commerce, he has both the ability and experience to effectively communicate these complex issues.

I was pleasedto serve on the Ways and Means Committee, but I was honored to serve with Kevin Brady. He ensured our hearings were thoughtful and engaging so Members could gain insight to craft legislation and shape policy, rather than creating CSPAN moments of drama for which politicians are so well known in the advent of social media.

He is a fierce advocate for his principles, yet is always diplomatic and respectful of opposing points of view. It was not a surprise that Congressman Richard Neal, the current Chairman of the Ways and Means Committee, called Kevin Brady’s retirement “a loss for both the Ways and Means Committee and Congress.”

Congressman Brady is also a fantastic mentor. He once served as the chairman of the Joint Economic Committee and he gave me important counsel when I became chairman of that committee.

I was also Kevin’s housemate in Washington for 10 years while I was in Congress and saw his unquestionable character firsthand. His keen insight and experience were invaluable to me in navigating and advancing my own legislative priorities, but more important was the time we spent together in conversations about our children, spouses, and home communities. Our families were able to get to know each other as well, and those relationships will continue for years to come.

In classic Brady form, he announced his retirement to his home community of friends at the Woodland Economic Outlook Conference and the local chamber of commerce he used to lead, instead of releasing a press release out of Washington, D.C. America needs more genuine people and real leaders like Kevin Brady.

Defense Update

By Al Jackson, Total Spectrum Strategic Consultant

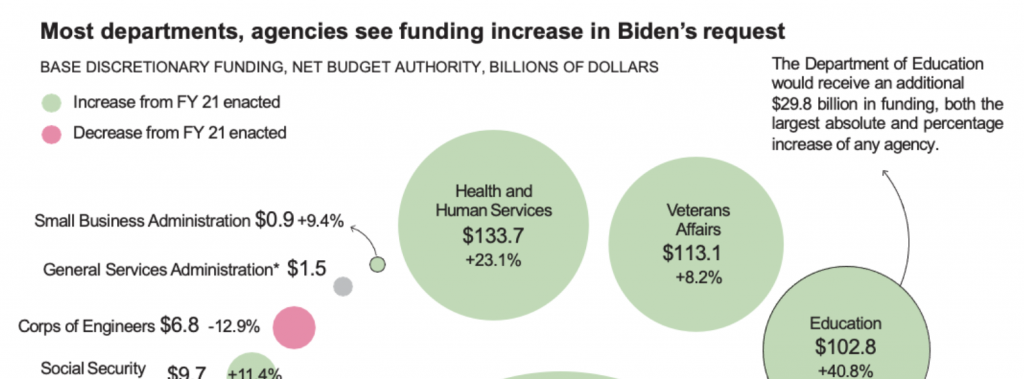

Earlier this month the Biden administration released a “skinny budget” for Fiscal Year 2022 with topline figures for each department. It included $715 billion for the Department of Defense, a 1.7% increase from FY2021. This number is shy of the FY2022 planned budget from the Trump administration, which would have been $722 billion. The entire proposed topline number is $753 billion, of which $38 billion is dedicated to other defense-related accounts such as the Energy Department nuclear weapons modernization accounts.

That number, which when combined with inflation results in a cut in defense spending in FY2022, which has drawn criticism from Republicans who desire a spending increase in the range of 3-5%. On the contrary, some Democrats from the more progressive liberal wing of the party want to spend less on defense and more on domestic programs. Administration officials have signaled that the budget would be released May 3, but that target has slipped due to competing priorities such as an additional COVID relief bill, two infrastructure spending bills, and a debt ceiling debate that will need to be resolved by August 1, 2021. Considering these, the budget from the administration will likely not be released until late May or early June. This delay will invariably raise the probability of a long-term continuing resolution which, in the past, has had a detrimental impact on the Defense Department. A delay on the release of a new administration’s budget is customary, however, a May/June release date is out of the ordinary.

In a return to budgetary order after 20 years of paying for wars in Iraq, Afghanistan, and Syria outside of the defense budget, the Biden administration is moving the Overseas Contingency Operations funding back into the base budget for FY2022. The move comes as part of the White House’s FY2022 budget request as the administration looks to wind down the presence of thousands of U.S. troops on the ground in Central Command’s area of responsibility, per the recent announcement related to the U.S. presence in Afghanistan.

One of the big winners in the budget proposal is the State Department, which sees a $6.8 billion increase in the budget, an increase of 12% over FY2021. The topline number is $63.5 billion, a request in keeping with the Biden administration’s focus on buttressing diplomacy, moving away from an “America first” agenda from the previous administration.

The House Committee on Appropriations is targeting the end of June to markup its version of the defense funding bill. Floor votes are expected by mid-July, as there is a commitment from House leadership to get every appropriations bill off the floor before the August recess. House Democrats have signaled the defense spending bill will mirror the federal budget, focusing on job creation, education and research, clean energy and climate resiliency as well as workforce development. This approach will hopefully appease progressive Democrats who would otherwise seek defense cuts.

Of the 61 Senate confirmed roles at the Department of Defense, only six nominations have been named and only the Pentagon’s top two civilians have been confirmed. Biden’s nominees for those jobs are expected to be considered by the Senate Committee on Armed Services, however, the process will face competition from other legislative priorities as it relates to floor time – COVID relief, infrastructure, etc.

As it relates to China, the defense industry has experienced a spike in Chinese company influence into the U.S. defense manufacturing base. According to decision science firm Govini, the presence of Chinese investment in the U.S. defense supply chain increased by 420% between 2010 and 2019. In an attempt to reverse that trend, former Pentagon acquisition chief Ellen Lord established the Trusted Capital program in January to encourage vetted U.S. investors to team with small tech firms focused on areas such as artificial intelligence, biotech, and other emerging technologies. This effort continues under the Biden administration, and has approved more than $311 million in potential partnerships between U.S. venture capital firms and small tech firms since January in an attempt to keep Chinese money and influence out.

Additionally, last month a new bipartisan House Committee on Armed Services task force was formed which will likely introduce language into the upcoming National Defense Authorization Act that will attempt to shore up support for domestic supply chains, thereby lessening the influence of Chinese companies in the U.S. defense manufacturing base. This task force is led by Rep. Elissa Slotkin (D-MI) and Rep. Mike Gallagher (R-WI).

Hearing Report

By Ramona Lessen, Executive Director, Total Spectrum

Senate Finance Committee Hearing to Consider the Nominations of Andrea Joan Palm to be Deputy Secretary of Health and Human Services and Chiquita Brooks-LaSure to be Administrator of the Centers for Medicare and Medicaid Services

Thursday, April 15, 2021; 9:30 AM

To view a livestream of the hearing please click here.

Opening Statements:

Senator Ron Wyden (D-OR), Chairman

Senator Mike Crapo (R-ID), Ranking Member

Witnesses:

Andrea Palm

Of Wisconsin, To Be Deputy Secretary

United States Department of Health and Human Services

Washington, D.C.

Chiquita Brooks-LaSure

Of Virginia, To Be Administrator Centers For Medicare And Medicaid Services

United States Department of Health and Human Services

Washington, D.C.

Senate Appropriations Committee Hearing

“The American Jobs Plan: Infrastructure, Climate Change, and Investing in Our Nation’s Future”

Tuesday, April 20, 2021; 10:30 a.m.

To view a livestream of the hearing please click here.

Opening Statements:

Senator Patrick Leahy (D-VT), Chairman

Senator Richard Shelby (R-AL), Vice Chairman

Witnesses:

The Honorable Pete Buttigieg

Secretary

Department of Transportation

The Honorable Michael Regan

Administrator

Environmental Protection Agency

The Honorable Gina Raimondo

Secretary

Department of Commerce

The Honorable Marcia Fudge

Secretary

Department of Housing and Urban Development

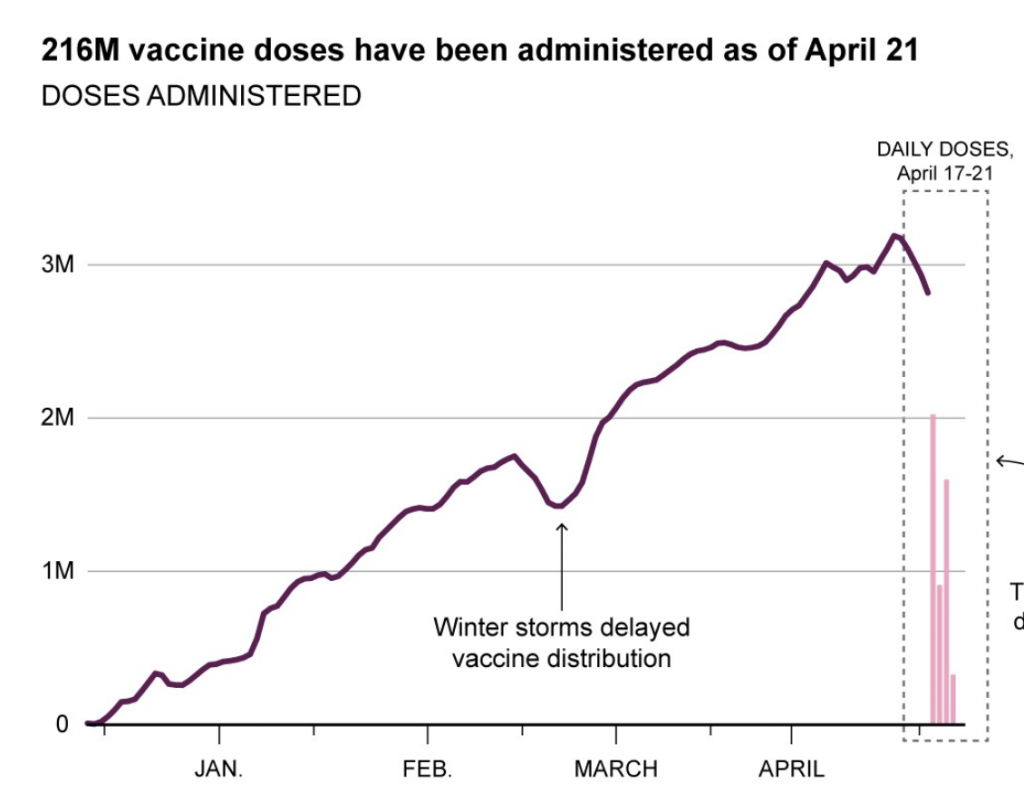

Vaccine Tracker: 51.5% of the U.S. has received first dose

Biden lays out first budget request

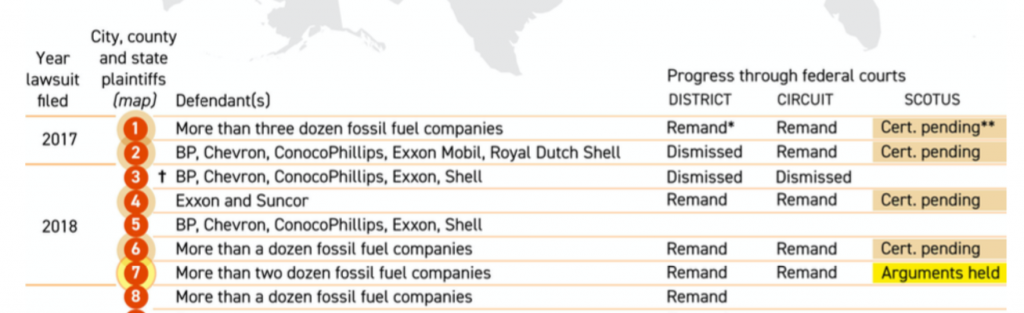

What you need to know about Climate Tort Litigation

What you need to know about Covid-19 Liability Protections

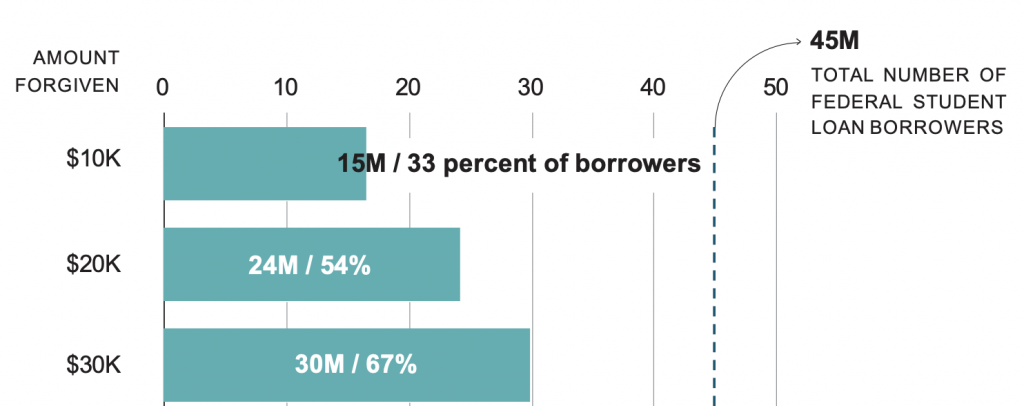

$50K student loan relief would erase most

federal borrowers’ debt

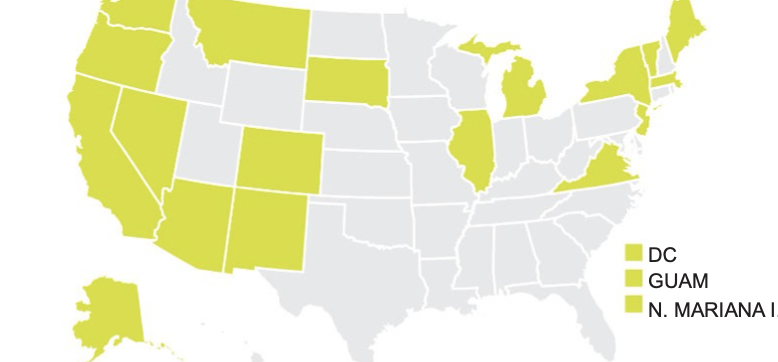

Rolling out legalization of recreational marijuana

Congressional Calendar – Week of April 19

All times in EDT

Tuesday, April 20

- 9:30 a.m. Senate Appropriations Subcommittee hearing on the Defense Health Program.

- 9:30 a.m. House Rules Committee virtual business meeting on three bills, including H.R. 1333, the NO BAN Act, which would limit presidential authority to impose travel bans.

- 9:30 a.m. Senate Armed Services Committee hearing to examine U.S. Strategic Command and U.S. Space Command in review of the fiscal 2022 defense authorization request and Future Years Defense Program.

- 10 a.m. House Agriculture Committee virtual hearing on the internet connectivity needs of rural America.

- 10 a.m. Senate Banking Committee virtual hearing on investing in rural communities.

- 10 a.m. Senate Commerce Committee hybrid hearing on strengthening the Federal Trade Commission’s authority to protect consumers.

- 10 a.m. Senate Finance Committee hearing on combating racial, ethnic, and gender disparities in the tax code.

- 10 a.m. Senate HELP Committee hearing to examine workforce training and modernization.

- 10 a.m. Senate Judiciary Committee hearing to examine voting rights.

- 10 a.m. House Small Business Committee hybrid hearing on the Small Business Association’s pandemic response program.

- 10 a.m. House Financial Services Committee hybrid markup of several bills, as well as the fiscal year 2022 budget views and estimates of the committee.

- 10 a.m. House Judiciary Committee markup on five bills, including H.R. 1843, the House’s version of the Covid-19 hate crimes bill.

- 10:15 a.m. House Education and Labor Committee virtual hearing on improving accountability and preventing fraud in the for-profit college system.

- 10:15 a.m. House Education and Labor Committee virtual business meeting to approve new subcommittee assignments.

- 10:30 a.m. Senate Appropriations Committee hearing on the American Jobs Plan, infrastructure and climate change. Transportation Secretary Pete Buttigieg, Environmental Protection Agency Administrator Michael Regan, Commerce Secretary Gina Raimondo and Housing and Urban Development Secretary Marcia Fudge testify.

- Noon. House Select Climate Crisis Committee virtual hearing on creating new jobs and economic growth through climate action.

Wednesday, April 21

- 10 a.m. Senate Foreign Relations Committee business meeting to consider three bills, including S. 1169, the Strategic Competition Act of 2021, which would set out a diplomatic strategy towards China.

- 10 a.m. Senate Judiciary Subcommittee on Intellectual Property hearing – Improving Access and Inclusivity in the Patent System: Unleashing America’s Economic Engine.

- 10 a.m. Senate Commerce Committee hybrid hearing on the nomination of Bill Nelson to be NASA Administrator and Lina Kahn to be a commissioner on the Federal Trade Commission.

- 2 p.m. Senate Appropriations Subcommittee hearing – FY 2022 Budget Requests.

- 2 p.m. House Homeland Security Committee virtual hearing on oversight of the Department of Homeland Security’s inspector general.

- 2 p.m. House Foreign Affairs Committee hybrid markup of 12 bills, including H.R. 1155, the Uyghur Forced Labor Prevention Act, which would aim to stop forced labor imports from China.

- TBA. Senate HELP Committee business meeting on the nominations of Julie Su for deputy secretary of Labor, Cynthia Marten for deputy secretary of Education and James Kvaal for undersecretary of Education.

- 2:30 p.m. Senate Small Business Committee hearing on the nomination of Dilawar Syed to be deputy administrator of the Small Business Administration.

- 2:30 p.m. Senate Judiciary Subcommittee on Competition Policy, Antitrust, and Consumer Rights hearing – Antitrust Applied: Examining Competition in App Stores.

- 2:30 p.m. Senate Commerce, Science and Transportation Subcommittee on Aviation Safety, Operations and Innovation hearing – Prepare for Takeoff: America’s Safe Return to Air Travel.

Thursday, April 22

- 9:30 a.m. Senate Armed Services Committee hearing to examine U.S. Central Command and U.S. Africa Command in review of the fiscal year 2022 Defense Authorization Request and Future Years Defense Program.

- 9:30 a.m. Senate Agriculture Committee hearing on the nomination of Jewel Bronaugh to be deputy secretary of Agriculture.

- 10 a.m. Senate Finance Committee hearing on U.S.-China relations.

- 10 a.m. Senate Judiciary Subcommittee on Criminal Justice and Counterterrorism hearing – Behavioral Health and Policing: Interactions and Solutions.

- 10 a.m. Senate Energy and Natural Resources Committee hearing on carbon dioxide utilization technologies.

- 10 a.m. Senate HELP Committee hearing on protecting U.S. biomedical research and preventing undue foreign influence.

- 10 a.m. Senate Banking Committee virtual hearing on the clean energy economy.

- 10:15 a.m. House Education and Labor Committee virtual members’ day hearing.

- 10:15 a.m. Senate Homeland Security and Governmental Affairs Committee hybrid hearing on the nominations of Kiran Ahuja to be director of the Office of Personnel Management and Anton Hajjar, Amber McReynolds and Ronald Stroman to be governors of the United States Postal Service.

This e-newsletter is produced by Total Spectrum/Steve Gordon and Associates and the Arizona Chamber of Commerce and Industry. The views expressed herein may include subjective commentary and analysis that are the views of the editors and authors alone. Information in this e-newsletter is obtained from sources believed to be reliable, but that cannot be guaranteed as independently investigated or verified. Information in this e-newsletter is not an endorsement, advertisement, recommendation, or any type of advice; political, legal, financial or otherwise. For questions about the content of this e-newsletter, please contact the Arizona Chamber of Commerce and Industry.

Add comment