The Paycheck Protection Program Flexibility Act (PPPFA) was signed into law last week, giving greater flexibility to the program that provides COVID-19 relief aid to small businesses.

The measure was a refreshing display of bipartisanship. The House on May 27 passed the PPPFA by 417-1, the Senate approved it by unanimous consent on June 3 and President Trump swiftly signed PPPFA on June 5.

Although there was disagreement in the Senates about some of the House bill language, the Senate opted to approve the measure and then apply changes.

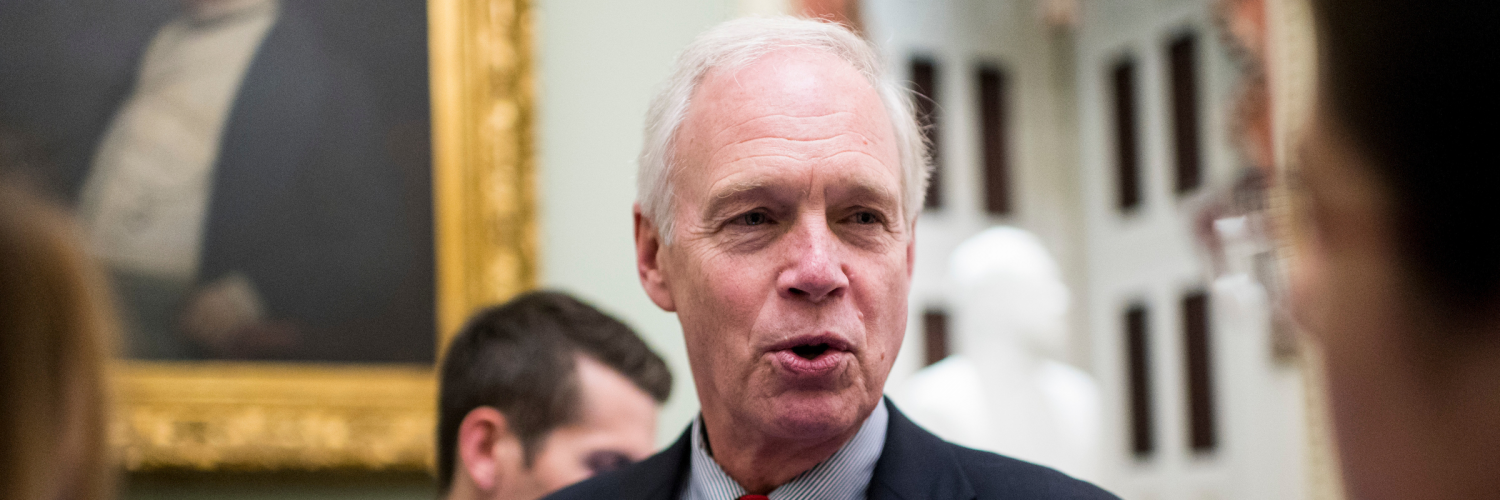

Senator Ron Johnson, R-Wis., blocked an initial attempt at unanimous consent because he wanted clarification on the language regarding the extension of the program’s extension to December 31. Sen. Johnson opposed the extension of the program and received a letter clarifying that the PPP extension to December 31, 2020 only applies to rehiring employees and not the program’s application deadline.

Senate Small Business and Entrepreneurship Chairman, Senator Marco Rubio, R-Fla., and Senator Susan Collins, R-Maine, are working on technical changes, particularly the language that creates a cliff for loan forgiveness linked to payroll spend. The current language disqualifies small businesses who spend less than 60% of their PPP loan from loan forgiveness altogether.

There are several important changes that PPP loan recipients should be aware of:

- Payroll spend requirement lowered to 60%

The percent of funds that must be spent on payroll was lowered from 75% to 60%, to be eligible for at least some loan forgiveness. But there also is now a cliff; payroll spend below 60% prevents any loan forgiveness. In addition, the list of eligible expenses does not change (rent, mortgage, utilities, and interest on loans).

- Time period to use funds extended to 24 weeks

Recipients now have 24 weeks to spend funds from the time of origination, to be eligible for at least some loan forgiveness. This is up from the original eight weeks. What is more, small businesses do not have to wait for 24 weeks to apply for forgiveness, they can still do so 8 weeks after.

- Deadline to rehire workers extended to December 30, 2020

Originally, small businesses were required to rehire workers by June 30, 2020 in order for their salaries to qualify for forgiveness, but under PPPFA that deadline has been extended and their salaries will qualify if the new deadline is met.

- Loosens hiring requirements

PPPFA states that a business can still receive forgiveness on payroll amounts if it meets any of the following criteria:Is unable to rehire an individual who was an employee of the eligible recipient on or before February 15, 2020;

1. Is able to demonstrate an inability to hire similarly qualified employees on or before December 31, 2020; or

2. Is able to demonstrate an inability to return to the same level of business activity as such business was operating at prior to February 15, 2020.

3. New guidance from the Small Business Administration (SBA) will be needed to elaborate on how to document these exceptions.

- Extends loan repayment from 2 to 5 years

A business now will have five years at 1% interest to repay the loan and the first payment will be deferred for six months after the SBA makes forgiveness determination. Currently, banks have 60 days to make a forgiveness determination and the SBA an additional 90 days, which means small businesses could have up until May of 2021 to make the first payment on their PPP loan.

- Deferment of payroll taxes for social security

PPPFA now allows borrowers to take advantage of the CARES Act provision allowing deferment of the employer’s payroll taxes for social security on the forgivable portion of the loan.

PPPFA addresses many of the concerns raised by the small business community. Once important technical changes are applied by Sen. Rubio and Sen. Collins, PPPFA will go a long way to ensuring small businesses have greater flexibility to use their PPP loan and maximize their loan forgiveness. With funding still available through PPP, these changes could instill confidence and encourage more small businesses to apply for the program.

Laura Ciscomani serves as the Development Director for the Arizona Chamber Foundation and the Arizona Chamber of Commerce and Industry.

Add comment